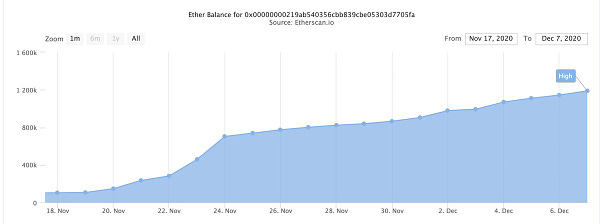

The eth2 deposit contract is continuing to gobble up ETH with almost 1.3 million ETH sent in for staking. As Eric Conner notes below, it’s increasing by about 40,000 ETH per day which is worth around $22.5 million at current prices - this is quite crazy when you think about the fact that nothing has changed and this ETH will still be locked for 1-2 years!

The eth2 deposit contract isn’t the only thing gobbling up ETH - DeFi has been doing it for quite a while with almost 7 million locked in various protocols. Maker still reigns supreme with 2.6 million ETH locked followed by Uniswap and Compound at 1.1 million ETH each. The ETH locked up in Maker and Compound is obviously being used as collateral to borrow other assets against (such as stablecoins) and the ETH in Uniswap is being used to provide liquidity across hundreds of different trading pairs.

I recall a tweet from Ryan Sean Adams that broke down where he thinks a bunch of ETH will be in ~2 years. First on his list are “never-sellers” aka those who really have no reason to ever sell their ETH and also aren’t staking it. Ryan thinks that this would account for 25% of all ETH but I think that’s pretty ambitious given that if someone is a never-seller then it’s more likely they’d be using their ETH as collateral in DeFi or staking it - leaving it to sit in a wallet is a waste! So I’d probably say that maybe 10% of all ETH will eventually just sit idle in cold storage.

Ryan also notes that he believes 15% of all ETH will be locked up on companies balance sheets (like we’ve been seeing with BTC) but I’d also extend this to DAO balance sheets. This is because there are many DAOs on Ethereum that are cultivating treasuries and it makes a lot of sense for these treasuries to own some ETH and/or use it in DeFi. Personally, I think it starts with DAOs gobbling up ETH and then in a few years we see traditional companies buying it up for their balance sheets. Though at that point they’ll probably be buying it at much higher prices!

All of these supply sinks for ETH are on top of ETH issuance dropping to <0.5% after the eth1 <> eth2 merger and EIP-1559 burning ETH possibly making issuance go negative so we could very well eventually see a “supply-side crisis” for ETH. I might get laughed at for saying this but I truly do believe that ETH has the potential to become the most scarce and sought-after asset in history - yes, even moreso than BTC.

Have a great day everyone,

Anthony Sassano

Join the Daily Gwei Ecosystem

All information presented above is for educational purposes only and should not be taken as investment advice.

Ethereum is the base layer that that the world's financial system will run on. Bitcoin is 'Digital Gold'. ETH will be the unit of account; BTC will lose relevancy when the primary currency in non-inflationary.

I beg to differ with your opinion that there is less than 10% of all ETH sitting idly. If you take a close look at the top Ethereum accounts (for example in etherscan.io), there are tens of accounts with 200k ETH, 150k ETH, 100k ETH and many other round numbers that have been sitting idly for years. So it is relatively safe to assume that they will continue to do so in the future. And if you add up the amounts in all those accounts, you will find that it’s more than 10%.

Also, there may be 10-25% of all ETH that has been lost forever due to the loss of private keys or death.