Creating a Symbiotic Relationship - The Daily Gwei #17

How to make the Ethereum network fair for everyone.

Before we get started, I wanted to make note of the fact that there is currently an EIP-1559 Community Fund grant live on Gitcoin. If you want to support this EIP then donating to this grant is the best way to do so. You can donate here.

EIP-1559 is probably the most well known Ethereum Improvement Proposal (EIP). This EIP will fundamentally change the way that the fee market works on Ethereum and add in a novel fee burning mechanism that would effectively burn (destroy) some ETH per transaction.

Ethereans celebrating ETH being burned (~2020/21, colorized).

There has been a lot of technical documentation written about this EIP already which you can read here and here (also David Hoffman’s piece is a long-ish read but really good). If you’re not familiar with all of the mechanisms of EIP-1559, I suggest reading those pieces as today I’m only going to summarise the impact that this EIP would have for the network as a whole and ultimately for the value accrual properties of ETH.

Let’s start with the impact it will have on user experience. As it currently stands, the fee market experience on Ethereum is horrible for end-users. The current auction-style mechanism frequently leads to fee over-payment to miners and it’s very difficult for users and wallets to estimate what fees should be paid per transaction.

This is where EIP-1559 comes in with the BASEFEE mechanism. BASEFEE is a number that increases or decreases based on the current congestion levels of Ethereum. If the chain is more than 50% utilized then the BASEFEE increases automatically whereas if it is <50% utilized, the BASEFEE would decrease. Furthermore, users are still able to jump the queue by paying a ‘tip’ on top of BASEFEE - David Hoffman elegantly explains both of these mechanisms below.

The beauty of this mechanism is that all of the fees (ETH) that are paid via BASEFEE are burnt and only the ‘tip’ is paid to miners. This prevents miners from manipulating the fee and also ensures that only ETH can ever be used to pay for transaction fees on Ethereum (no chance of economic abstraction). As David Hoffman puts it in his piece: “This is comparable to a nation-state demanding that only their native currency be legal tender.”

It’s also worth noting that there is another EIP (EIP-2593) which is being advertised as an alternative to EIP-1559. You can read a detailed breakdown of that here.

Alright, onto the broader topic of what the fundamental value accrual properties of ETH are. As I see it, there are three key properties:

Use as trustless collateral on Ethereum (within DeFi)

Staking in eth2

Fee burning

As it currently stands, we only have 1 of those properties (the first one) with staking coming sometime in the next few months and fee burning via EIP-1559 estimated to be deployed within 6-12 months from now (if it’s accepted into an Ethereum network upgrade/hard fork). There are other reasons why ETH is valuable (which I detailed here 18 months ago) but these 3 properties are the fundamental drives of value to ETH.

Okay onto what the title of this piece is all about! All apps that are built on Ethereum are currently parasitic in that their on-chain activity does not add fundamental value to ETH. This is because they are “free-riding” on top of the platform - the only toll they (and their users) pay is in the form of gas fees which goes directly to miners. This fee is effectively washed back and forth between participants on the network: user buys ETH > user pays fee > miner takes fee > miner may sell the fee (ETH) back into the market > cycle begins again.

With EIP-1559, we have a chance to break this cycle and turn this parasitic relationship into one that is symbiotic for all participants of the Ethereum network. Instead of the entire fee going to the miner, a portion of it (the BASEFEE as described above), would be burnt which effectively removes that ETH from the total supply.

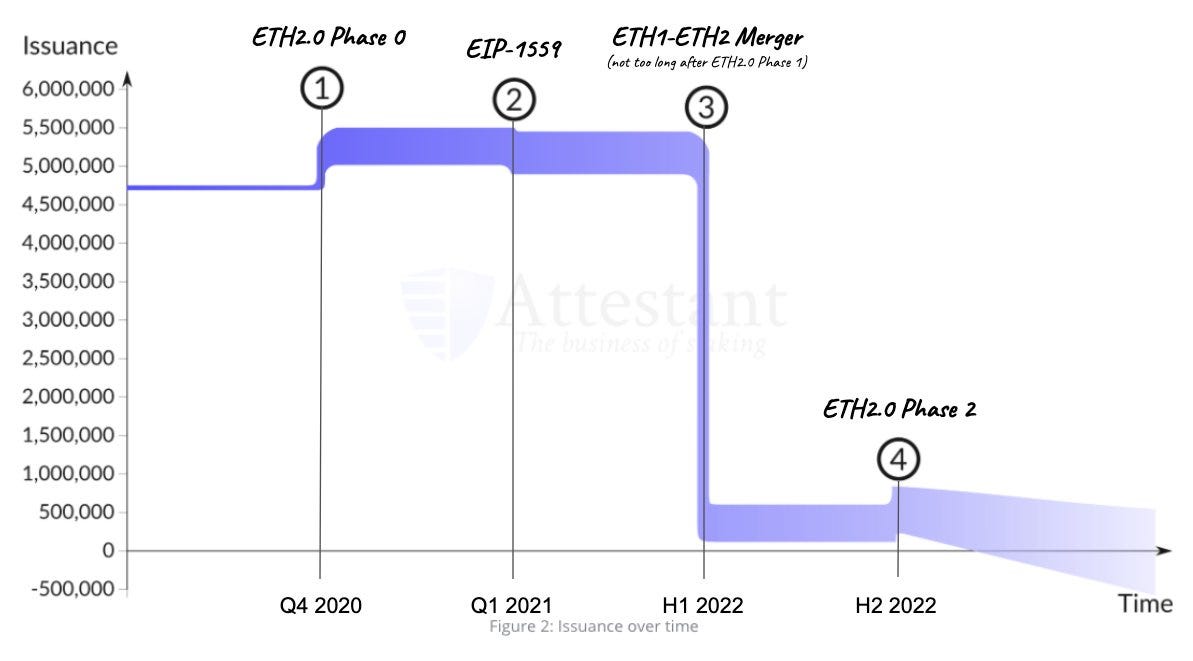

Over the long-term, the implications of burning ETH are quite profound. With eth2, the rewards that are paid out to validators (stakers) are much less than those currently paid out to miners (which is currently ~4.5% annualized). For example, if 10 million ETH is staking in eth2 then the overall network issuance rate is only 0.54% (as shown in the chart from EthHub here). Then we can take into account fee burning which may get to a point where it completely offsets the new ETH being generated by the protocol to pay validators. This all culminates in a long-term net negative issuance rate for Ethereum - visualized nicely in the chart below.

Chart source: https://twitter.com/JimmyRagosa/status/1258396800685428738

To summarize: this is Ethereum with EIP-1559:

Users get better fee estimations and UX

Miners/validators still get paid via the ‘tip’ and protocol issuance

Apps that use Ethereum pay their dues in burnt ETH

ETHs fundamental value increases > protocol security increases > apps inherit that security

Thus, we have a symbiotic relationship.

Have a great day everyone,

Anthony Sassano

If you’d like to support my on-going work to bring you a fresh Ethereum-packed newsletter every week day, feel free to make a donation on Gitcoin here (during the current matching round a 1 DAI donation is currently being matched on my grant by 40 DAI)!

All information presented above is for educational purposes only and should not be taken as investment advice.

Follow and Support Me

Donations (sassal.eth and my Gitcoin Grant)

EthHub (ethhub.eth)