Ethereum protocol development is currently split into 2 distinct paths - eth1 (also referred to as eth1.x) and eth2 - these two are due to eventually meet at some point in the future. This meeting will happen in the so-called “phase 1.5” of the Eth2 rollout plan which was originally detailed here and then simplified here in late 2019. Later on, in April of 2020, Alex Stokes put together a post detailing what eth2 would need from eth1 over the next six months with Danny Ryan following this up with a detailed write-up of what an eth1 and eth2 relationship may look like. If you are unfamiliar with the eth2 rollout plan I suggest reading this page first before continuing to read this (do note that phase 1.5 isn’t on that page yet).

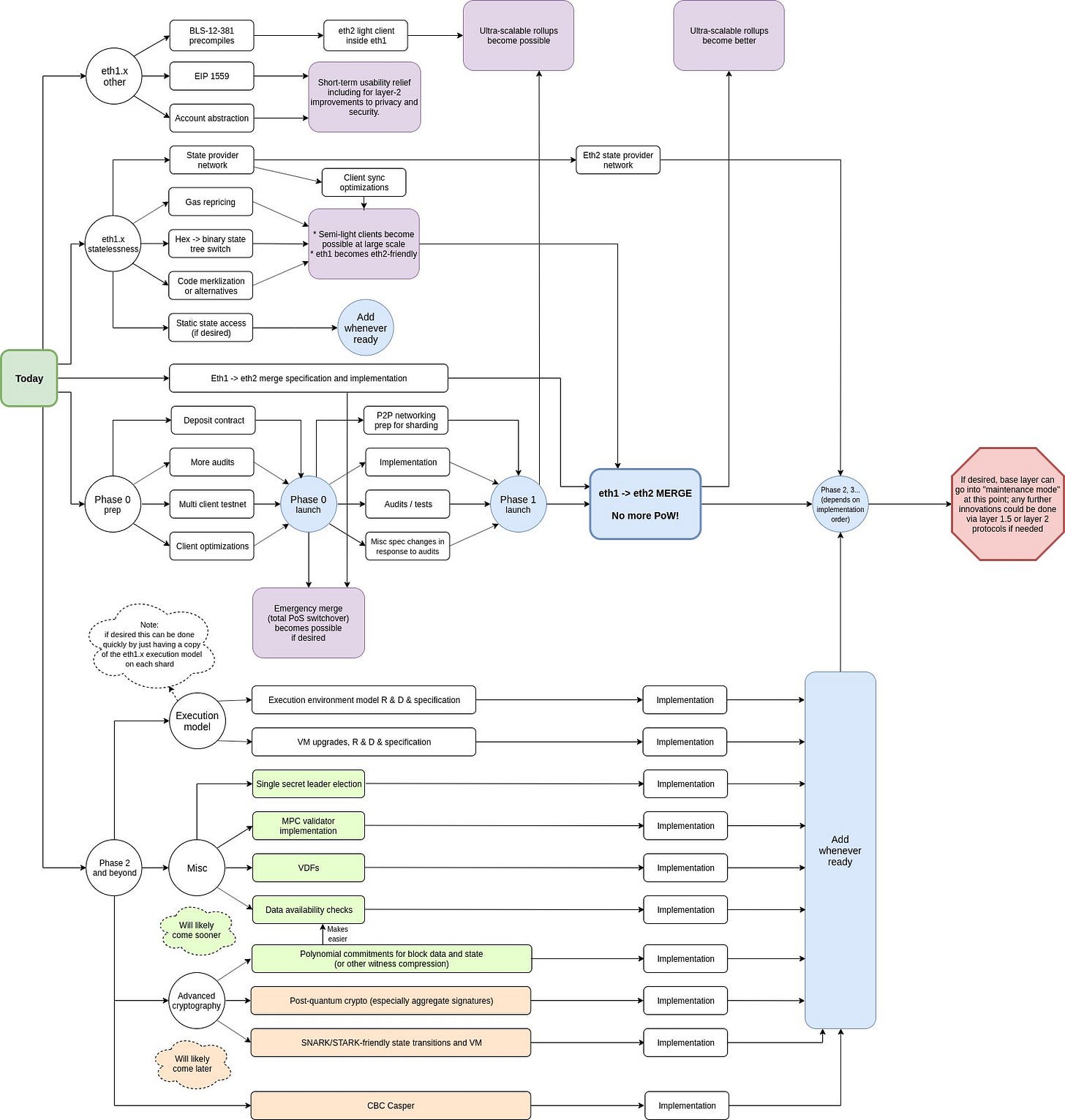

Source: Vitalik’s personal roadmap for Ethereum

To put it (very) simply, the planned rollout and merger is envisioned to go like this (please take the dates I’ve assigned to each milestone with a huge grain of salt):

Work on making eth1 ready for the merger begins (2019)

Phase 0 (beacon chain) of eth2 deployed (2020)

eth1 merger work continues (2020/21)

Phase 1 (shard chains) of eth2 deployed (2021/22)

eth1 merger work completed (2021/22)

eth1 gets folded into eth2 becoming shard #0 (2022)

Original eth1 chain “dies off” (2022)

Now, it’s important to keep in mind that this is the ideal scenario for a smooth and uneventful merger but, as we all know, things are rarely this simple in crypto. So, let’s explore some of the concerns around this merger.

The largest and most obvious concern is the possibility of a “miner revolt” where miners try to play games with the eth1 chain before/during/after the rollout of eth2 and eventual merger.

These games could come in the form of:

Miners blocking deposits to the deposit contract (doing so would prevent people from sending their ETH to eth2 to stake)

A minority group of people and miners decide to continue on with the eth1 chain

Miners block the eth1 merger work that gets deployed via eth1 network upgrades

In terms of likelihood that any of these concerns would play out, I’d say that #1 is very unlikely, #2 is highly likely (especially if a large exchange keeps the “eth1 coin” listed) and #3 at very unlikely. I also think that even if #2 is highly likely to happen, it doesn’t really have any material impact on Ethereum as miners are only one small part of the Ethereum governance process and I believe all of the other important parties (developers, app owners, community members, economic nodes/exchanges) would simply move over to eth2 without any drama.

There are also concerns around the issuance of ETH when phase 0 of eth2 goes live. This is because when the Beacon Chain is launched, eth2 will have it’s own issuance schedule that is independent of eth1. This results in a net increase to overall ETH issuance of anywhere between 0% to 1% which would make ETHs overall issuance (eth1 + eth2) roughly 5.5% a year. Things such as EIP-1559 (if implemented on eth1) may mitigate this by offsetting issuance via burned ETH and since all ETH sent to eth2 is locked for a while, it works to take some ETH out of circulation on eth1 (at least, temporarily).

In saying that, there is a concern that there will be a “supply shock” when eth1 is merged into eth2 because as it currently stands, once you send your ETH from eth1 to eth2, it is locked there until the merger. So if for example 5 million ETH is migrated from eth1 to eth2 before the merger happens, the concern is that once eth1 is merged into eth2, that 5 million ETH (plus the additional ETH issued as part of eth2 block rewards) would suddenly flood the market and the price of ETH would crash.

I generally believe that this concern is overstated for a few reasons. Firstly, just because that 5 million+ ETH is put back “into circulation” doesn’t mean that it’s immediately going to be sold. Most of that ETH will be “locked up” in that it’ll be being used for staking. Of course, there could be “mass withdrawals” if the price of ETH skyrocketed to $10,000 or something where people are itching to offload their positions. Though, this is mitigated by the fact that there’s actually a minimum withdraw time for validators (stakers) in eth2 of ~18 hours and this minimum time increases as more people try to withdraw at once. In theory, if most people tried to withdraw at the same time, then it’d take weeks to months for all of that ETH to be withdrawn.

This post is just meant to give an overview and primer of the eth1 <> eth2 merger. In reality, there are a lot of moving parts to this merger and things can and do change frequently as well as additional concerns that I haven’t covered in this piece. Oh and don’t ask me for an estimated date for this merger - only the Ethereum gods know the answer to that question.

Have a great day everyone,

Anthony Sassano

All information presented above is for educational purposes only and should not be taken as investment advice.

Follow and Support Me

Donations (sassal.eth and my Gitcoin Grant)

EthHub (ethhub.eth)