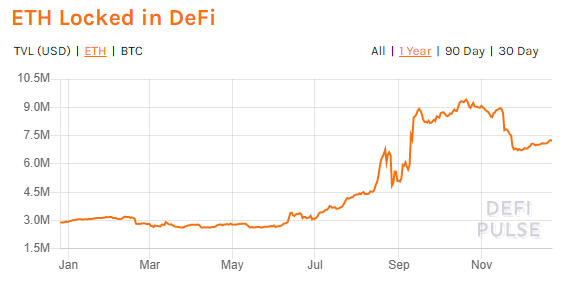

The ‘ETH Locked in DeFi’ metric is a favorite among Ethereans because it shows that there is substantial demand to use ETH as a trustless asset within DeFi - whether that be as collateral in Maker, Compound and Aave, as a trading pair asset on Uniswap or really doing anything else within DeFi. It also shows that people would rather hold their ETH and leverage its properties as a strong collateral instead of selling it for something else.

As you can see from the chart above, ‘ETH Locked in DeFi’ has come down from a peak of 9.3 million to a local low of 6.7 million and is now trending back up (at around 7.3 million). In USD terms, 7.3 million ETH is currently worth $4.5 billion dollars which accounts for 30% of the overall USD locked in DeFi. Of course, these raw numbers don’t tell us the whole story and for that we need to dig deeper into why this drop happened.

Most of the drop in ETH locked happened because of the ending of Uniswap liquidity mining rewards (as I discussed yesterday) and you can literally see that in the chart here (click the ‘ETH’ option on the chart). Basically, around the time that the UNI rewards ended, Uniswap went from having 3.25 million ETH locked to 1.15 million in 10 days. Of course, some of this ETH went into other DeFi protocols but the majority doesn’t seem to have been put back into DeFi. What may have actually happened is that a lot of this ETH went into eth2.

Chart source: https://www.duneanalytics.com/hagaetc/eth2-0-deposits

As you can see from the chart above, there’s almost 2 million ETH in eth2 at time of writing and I think there’s some overlap between those who use ETH in DeFi and eth2 stakers. I personally know many ETH holders who used their ETH in DeFi heavily during DeFi summer and then sent a lot of that ETH to staking (for various reasons). On top of this, the 2 million ETH in eth2 is almost exactly the amount of ETH that was withdrawn from DeFi from November 15th to November 25th. Now obviously not all of this ETH went into eth2 but I do think the numbers are curious here - I might do some more digging into this if I find some time!

I’ve said it plenty of times but the amazing thing about ETH is that it is a versatile asset for a versatile network. You can use it as collateral, as gas, as a store of value, as an internet bond in eth2 staking and, of course, as money! You don’t even have to leave the Ethereum ecosystem to do any of this - all you need is your own wallet and an internet connection to go bankless with your ETH.

Have a great day everyone,

Anthony Sassano

Join the Daily Gwei Ecosystem

All information presented above is for educational purposes only and should not be taken as investment advice.