Incentives make the world go round and it’s what enables the blockchains we all know and love to even function in the first place. “Liquidity mining” or “yield farming” took these traditional Proof of Work incentives that were usually reserved for validating a blockchain and applied them to DeFi apps in the form of “Proof of Liquidity/Capital”. Due to this, measuring the total AUM of different protocols via the raw numbers alone does not paint the entire picture - rather, we should measure it by the amount of AUM that is not incentivized.

So in the example above, Lemonade Alpha is pointing out that 33% of the total AUM of the Index Coop is not incentivized - that is, 33% of the DeFi Pulse Index’s (the only product the Index Coop manages at the moment) AUM is not currently participating in the DPI/ETH liquidity mining program on Uniswap which is paying out INDEX token rewards. On the other hand, similar protocols have much less unincentivized AUM which shows that people are mostly just depositing their liquidity or buying these assets in order to farm some other asset.

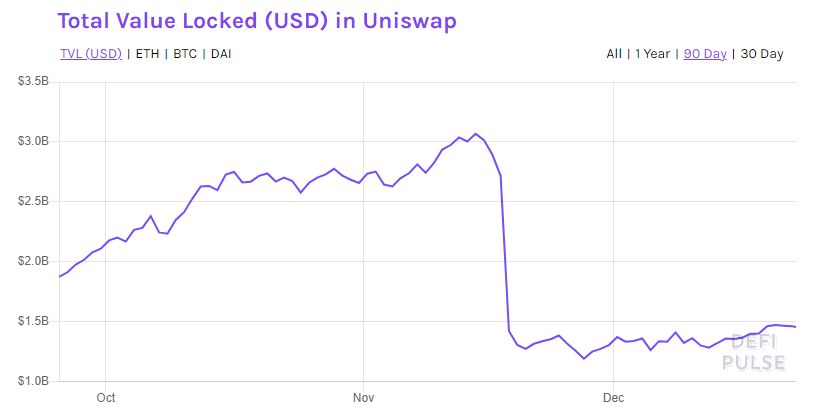

This doesn’t just apply to the above protocols - it applies to every single one on Ethereum - even the largest ones like Uniswap. From the chart below you can quite obviously see the large drop that happened the moment the UNI farming rewards ended - $1.7 billion worth of liquidity (out of the total $3 billion at the time) was withdrawn from Uniswap as it was only there for the UNI rewards. Given that we know this liquidity is “mercenary”, we can assume that some of it went to SushiSwap to farm SUSHI rewards and assume most of the rest of it went to other DeFi protocols that were paying out token rewards.

Source: https://defipulse.com/uniswap

So if liquidity isn’t a good measure of incentivized usage, what is? Well I think for something like Uniswap the number one thing that matters is trading volume as that is where the fees come from to pay liquidity providers (LPs). According to this Dune Analytics dashboard, Uniswap is currently doing $3.2 billion worth of volume a week (generating almost $10 million worth of fees for LPs) whereas the incentivized SushiSwap is doing $602 million volume a week (generating $1.5 million worth of fees for LPs and $300,000 worth of fees for SUSHI stakers). This is mainly because SushiSwap only has liquidity on the pairs that it is incentivizing with SUSHI rewards whereas Uniswap has liquidity on the long-tail of ERC20 assets and is usually the first place a new token gets “listed” within DeFi. This just shows that the non-mercenary capital will stick around for other reasons - in Uniswap’s case it is a mixture of brand awareness, trust in the platform, fees generated for liquidity providers and a bit of loyalty.

Going beyond decentralized exchanges, we can look at the money markets like Compound and Aave. I think it’s quite fascinating that Aave has $1.7 billion worth of AUM without incentivization whereas Compound has $1.86 billion but is paying out COMP rewards for this liquidity. As you can see, there isn’t much of a difference in AUM here and I think one of the main reasons is that Aave supports more assets than Compound does (such as LINK and YFI) which pushes their AUM up via natural demand to use these assets as collateral. I’d be very interested to see how much of Compound’s AUM would stick around if the COMP rewards were to end.

DeFi protocols need to not be reliant on subsidizing liquidity in perpetuity if they are to succeed over the long-term. I think it’s fine to pay out token rewards as an incentive at the start and as kind of a carrot to get people to use a protocol, but if a product requires constant token emissions to retain its liquidity/AUM then that’s the market saying that it’s probably not a very good product.

Have a great day everyone,

Anthony Sassano

Join the Daily Gwei Ecosystem

All information presented above is for educational purposes only and should not be taken as investment advice.