The Ethereum DeFi Liquidity Vortex - The Daily Gwei #21

Ethereum will suck all types of assets into its gravity well.

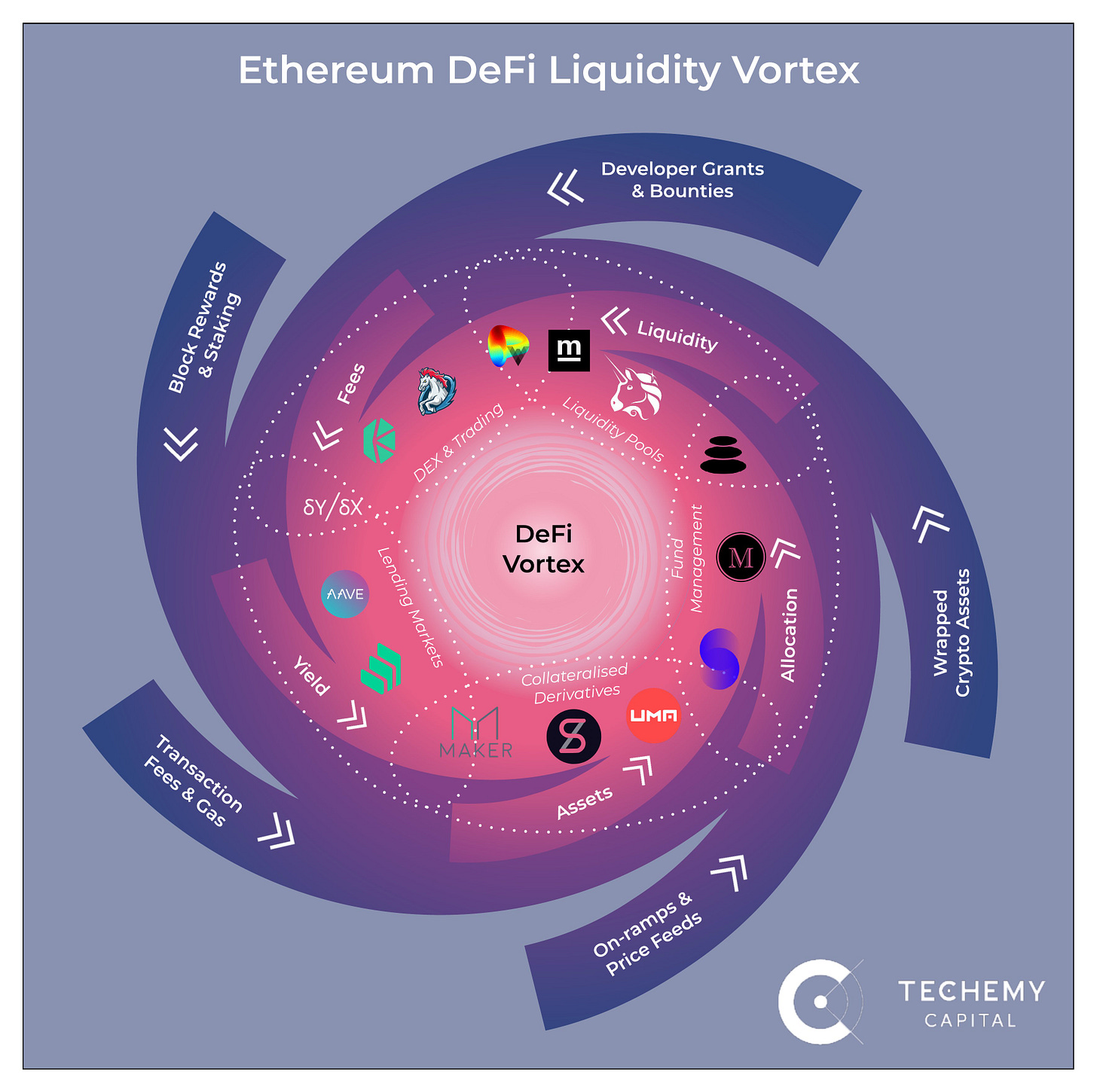

Ethereum is currently on track to consume all assets (financial or otherwise) inside and outside of crypto. For example, in just the last few weeks, 6200 BTC (~$56 million) has migrated to the Ethereum network from Bitcoin. The image below basically summarizes what Techemy Capital likes to call the Ethereum DeFi Liquidity Vortex which illustrates how Ethereum sucks in assets via various DeFi protocols.

Source: https://twitter.com/paulsalis/status/1278920299136741378

In the financial world there is a saying of “liquidity begets liquidity”. What this means is that as more liquidity is added to a market, it attracts more users who add more liquidity which then attracts even more users who add liquidity and this quickly snowballs and becomes a self-perpetuating cycle.

This is exactly what the vortex above is showing! As more assets are migrated to Ethereum, it leads to more liquidity for DeFi protocols and because of the composability or “money lego” nature of Ethereum, the liquidity and assets are shared across all of the protocols which essentially creates the vortex. In addition to this, “yield farming” (aka liquidity mining) accelerates this liquidity growth through various subsidies.

So, why is Ethereum able to suck in so many assets? Because when assets are migrated to Ethereum, they are supercharged and become programmable. BTC on the Bitcoin network is what I like to call a “pet rock” as you can’t do much with it but if you bring it to Ethereum you get access to the entire DeFi suite. For example, you can put your WBTC, renBTC or sBTC into a Curve pool to farm SNX, REN, CRV and BAL. This is “yield farming” to the extreme and obviously won’t last forever but doing this sort of thing on Bitcoin is impossible. In saying that, BTC is just one of many assets that Ethereum will suck into its gravity well over the coming years.

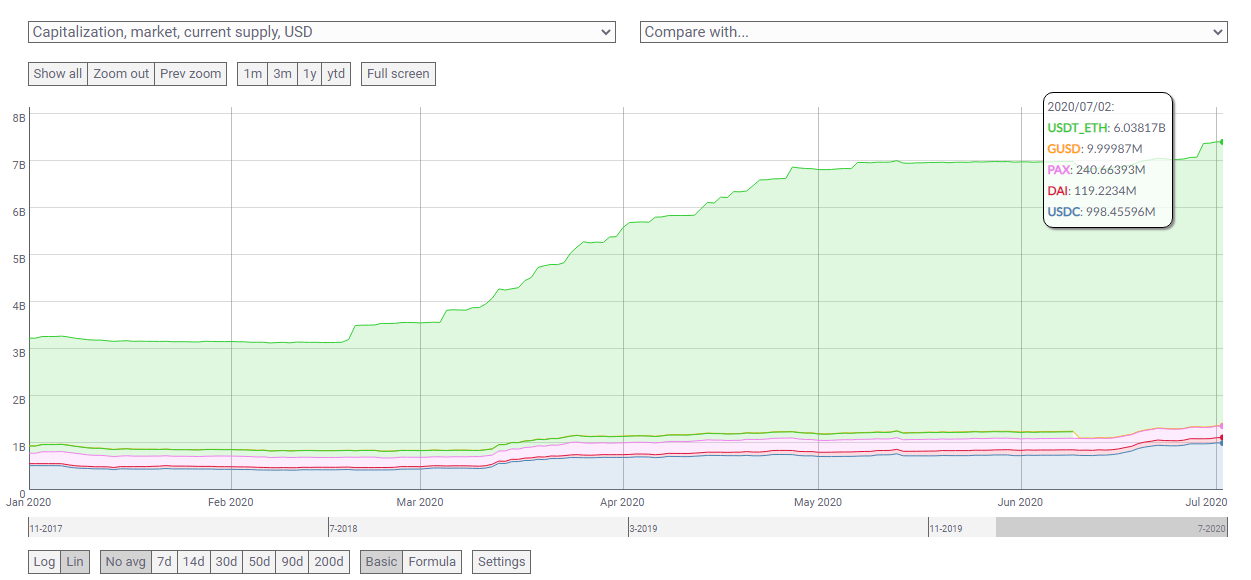

Another suite of assets that have seen explosive growth on the Ethereum network over the last few months is, of course, stablecoins - in particular, Tether (USDT).

Source: https://coinmetrics.io/charts

Not only have stablecoins seen tremendous growth in market cap, but they have also become the dominant collateral inside DeFi protocols with DAI, USDC and USDT now accounting for most of the assets lent out to Compound and a healthy amount of the assets lent out on Aave. Stablecoin pools are also the largest pools (as measured by liquidity) across AMM’s like Curve and Balancer because they tend to give the highest yield (outside of governance token incentives of course).

Now we get to the middle of the vortex which I think is where ETH should sit as it’s the only asset on Ethereum that has special privileges. This is because ETH is the only asset on Ethereum that can be used to pay for fees at the protocol level, the only asset that can be used to stake on eth2 and the only fully trustless and decentralized asset on Ethereum. All other assets that migrate to Ethereum are foreign and do not gain any special privileges - they also have to deal with being centralized or having single points of failure in how they’re bridged or “migrated” to Ethereum.

I’ve written about how I believe that ETH is going to be able to capture a lot of the value/liquidity/usage generated on Ethereum via fee burning and in addition to that, staking ETH in eth2 stands to offer quite a lucrative return which will also drive demand for ETH. Additionally, as ETH is the only trustless native store of value on Ethereum, people will continue to utilize it as robust collateral within DeFi apps.

I haven’t even touched on all of the other assets that are being tokenized on Ethereum like NFT’s such as gaming items or collectible art and traditional assets such as real estate (through RealT). I’ll probably write about these assets in future pieces but for now I’m signing off!

Have a great weekend everyone,

Anthony Sassano

All information presented above is for educational purposes only and should not be taken as investment advice.

Follow and Support Me

Donations (sassal.eth and my Gitcoin Grant)

EthHub (ethhub.eth)

Awesome post as usual. Would love to see a dedicated article about TradFi to DeFi "bridge" projects such as RealT and DMM, and how they will funnel outside value into crypto.