If you’d like to support my on-going work to bring you a fresh Ethereum-packed newsletter every week day, feel free to make a donation on Gitcoin here (during the current matching round a 1 DAI donation is currently being matched on my grant by 36 DAI)!

Decentralized governance is hard but making sure someone doesn’t game your token distribution method is even harder. Today, the Balancer Labs team learnt that lesson the hard way as a large centralized exchange attempted to game the rules of the BAL governance token distribution.

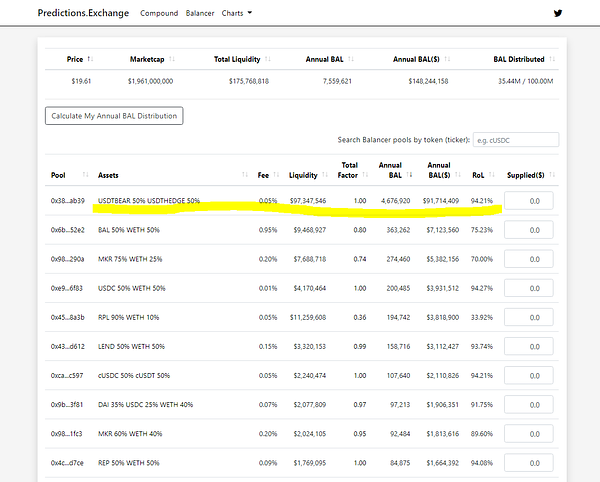

First, a little bit of context. Balancer has been running a liquidity mining program (similar to Compound) for a few weeks now. The key difference here is that Balancer’s program has been manual - they are simply snapshotting a list of addresses that are providing liquidity to the protocol and paying out the BAL governance token manually to them. Yesterday, a centralized exchange called FTX attempted to game this distribution by providing a very large amount of liquidity (roughly 50% of the total Balancer liquidity) in the form of their own exchange tokens (USDTBER and USDTHEDGE).

Now, why was FTX able to do this? If the BAL tokens are being paid out manually, can’t the Balancer team just blacklist these tokens effectively removing them from the pool of eligible reward payouts? Of course they can and that’s where the drama over the last 24 hours begins.

Following FTXs addition of these tokens to Balancer, a lot of discussion started happening in the Balancer Discord server and some community members were asking the team to blacklist FTXs addresses and not pay out any rewards to them as they believed it was unfair (since, in theory, FTX can print as many of these tokens as they want and price them at 0 risk). After hours of deliberation in the server, Balancer Labs posted a tweet stating that they will honor the distribution of BAL tokens to FTX (and all contributors) up to Ethereum block #10331138 but implement a whitelist of “eligible tokens” after that block number. This decision was made because the founders and core team members believed that changing the rules retroactively to deny FTX their accrued rewards goes against the “code is law” principle of these systems.

This decision split the community and people that were against paying FTX any rewards felt that their voices weren’t heard (there are literally thousands of messages in the governance channel in Balancer’s Discord discussing it all). To summarize the argument against paying the rewards: it was basically that letting FTX game the system and get away with it was rewarding bad behavior and setting a bad precedent.

Shortly after this decision was posted by Balancer, SBF (CEO of FTX) put together a Twitter thread on his thoughts regarding what had happened over the previous few hours. His main points centered around how the “governance” that led to this decision played out - namely that it was done in a Discord channel instead of using the actual governance token. Then later on in the day, he announced on Twitter that FTX would be donating the ~2000 BAL tokens that they accrued to a charity of the Balancer teams choosing.

What is even crazier is that around the same time that these discussions were going on, a whale decided to market sell all of their BAL which effectively cut the price down by about 60%.

Source: https://dex.blue/trading/#BAL/ETH

It’s unclear if this was a disgruntled BAL holder or not but the timing is obviously suspect and doesn’t leave much to the imagination. It is certainly a newer form of protest that I don’t remember having seen before.

As I said at the start of this piece - governance is hard. In this case, the governance was done subjectively via Discord to reach “rough consensus” to implement a contentious change. A few members from the wider community chimed in on this decision too including Kain from Synthetix who agreed with the Balancer teams decision because he believes in doing small scale experiments and rapidly iterating on them in order to stay ahead of those that try to game the system. DegenSpartan also agreed with Balancer’s decision on the principle that its important not to make decisions that are applied retroactively because he believes that it’s the same thing as stealing.

Obviously, the decision was always ultimately up to the Balancer Labs team because they retain control over the payouts of the BAL tokens. I believe that they played it right by letting the community discuss what to do in the Discord but I did notice that there were times when I felt some members were being ignored and their voices drowned out by a decision that had already been made without them.

At the end of the day, governance is all about striking a balance between ideology and pragmatism.

Have a great day everyone!

All information presented above is for educational purposes only and should not be taken as investment advice.

Follow and Support Me

Donations (sassal.eth and my Gitcoin Grant)

EthHub (ethhub.eth)

great synopsis to what may have not been known by many or discussed in the community outside the discord of BAL

Great read Anthony, thanks!