The question on everyone’s mind over the last 24 hours, is the COMP distribution priced in?

Compound is using a novel token distribution mechanism that’s come to be known as “liquidity mining”. What this means is that, rather than selling tokens in an ICO, they are distributed to people who participate in helping to grow the protocol. In this case, COMP tokens are awarded to those who supply liquidity to or borrow assets from Compound. The end-goal is to, of course, increase usage and liquidity of the protocol. It is definitely working too - assets locked in Compound has increased by ~$76 million to a total of ~$210 million.

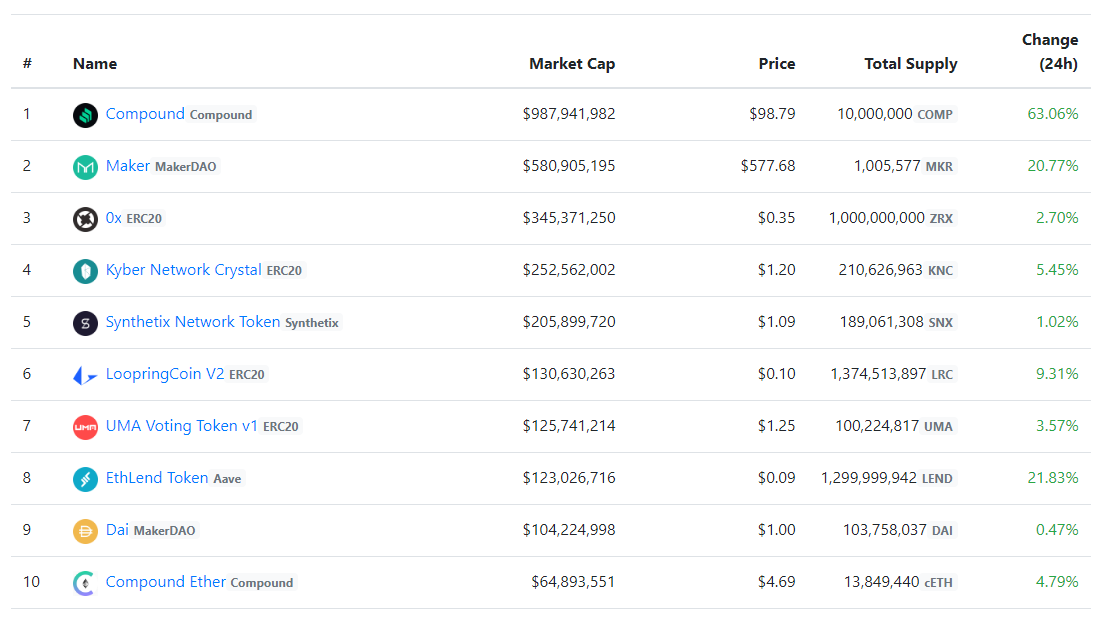

Though, the thing that is really causing a stir over the last 24 hours is the really high market cap which is currently sitting at ~$990 million based on fully diluted COMP supply. This gives COMP a price of ~$99 each (trading on Uniswap) and makes it the most valuable “DeFi token” on the market.

Image source: https://defimarketcap.io/

What people seem to be missing though is that this number by itself does not tell the whole story. First of all, the total supply of COMP tokens will eventually be 10 million but the current circulating (free float) supply is around ~2.4 million COMP. This figure comes from the Compound Labs shareholder pool (details below) and the first day rewards of ~2900 at time of writing. That’s ~24% of the total supply and you can assume that these ~2.4 million COMP aren’t going to be dumped on the open market all at once. That would give COMP a market cap of ~$237 million based on circulating supply - much lower than the current market cap. Now you can see why the valuation is so high.

Let’s break down how the rest of the COMP tokens are being distributed. ~42.2% of the total supply is being emitted via the liquidity mining program (more on this below) and the other ~57.8% is broken down as follows (from Compounds post):

2,396,307 COMP have been distributed to shareholders of Compound Labs, Inc., which created the protocol (as mentioned above) - unclear if these tokens are locked up or vesting (I’m assuming they aren’t)

2,226,037 COMP are allocated to the founders & team, and subject to 4-year vesting

372,707 COMP are allocated to future team members

775,000 COMP are reserved for the community to advance governance through other means - which will be announced at a future date

The remaining 4,229,949 COMP are being distributed via the “liquidity mining” incentive program. ~3000 COMP is being paid out every day at a rate of 0.5 COMP per Ethereum block (roughly every 15 seconds) to people who supply and borrow on Compound (50% for each function). You can use this nifty tool to calculate current ROI based on which assets you want to supply/borrow. Emission of COMP via the protocol will last for ~4 years.

It’s too early to tell how much of this freshly minted COMP will be sold onto the open market each day. The emission schedule reminds me of a Proof of Work chain but the key difference here is that COMP farmers don’t have huge on-going costs like electricity and mining hardware upkeep/maintenance - but they do have capital opportunity cost (plus whatever they pay in borrow APY which is currently offset by COMP distribution). Oh and of course smart contract and asset risk!

Taking all that into account, let’s do some (really) rough math here. I’m just going to assume that 50% of the COMP tokens (1500) might be sold each day (in reality it could be more, could be less). At current prices, that’s ~$148,000 that needs to be bought up every 24 hours. More importantly than the cost though, we need to ask: who’s buying COMP on the open market? Why buy it when you can just farm it on Compound in a much more capital efficient way? Obviously there will be market makers and bots arbing the spreads between exchanges but I’m just not sure where the demand from the general public will come from when they could just farm it via the protocol. It seems that the inflated market cap probably won’t last long as tokens begin flooding the market from shareholders/investors, founder & team vesting, and on-going protocol emission.

Will COMP go the way of Zcash? We’ll find out soon enough!

For those interested, you can monitor the on-going COMP distribution here.

Have a great day everyone!

All information presented above is for educational purposes only and should not be taken as investment advice.

Compound isnt decentralized and focus is on pump TVL with "stablecoin farming". Early investors have goal to pump token price for better ROI. Users of protocol risk to much but dont have governance power to direct protocol in way to become decentralized (own by real users). DAI liquidation event was the right indicator how Compound holders (owners) react on technical failure. Users funds have been devastated by manipulation and they refuse to compensate them. But most of that big holders was voted on proposal for that oracle solution (Coinbase).

So, dumping COMP because of tokenomics isnt problem for now. Cartel holders structure are problem.