Stablecoins - we all use them, we all love them - but we also know that they aren’t all created equal. USDT is opaque and has been under heavy scrutiny for years, USDC is more transparent than USDT but still centralized, BUSD is directly tied to Binance (which means it benefits or suffers from things that happen to Binance) and DAI is backed by ~50% USDC (effectively neutering most of it’s decentralization claims).

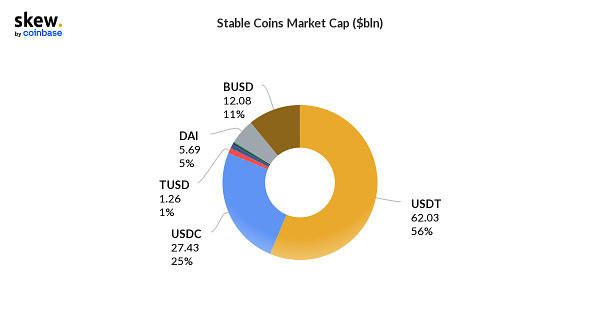

The one bright spot among all the drama is that over the last couple of years the stablecoin ecosystem is becoming much more diverse. No longer does USDT have total dominance over the space and it will soon no longer account for even 50% of the total stablecoin supply. Though when I bring this fact up in some circles, I get push-back from people who say that we’re really just replacing USDT with more of the same - and they are totally right - but I think the key difference here is that we can at least be somewhat relieved that we have ‘backups’ in case one or more of these stablecoins disappears for whatever reason (while acknowledging that there’s still large risks).

I’ve written about what I think it takes to create the perfect decentralized stablecoin before (check that out here), but unfortunately we haven’t really seen much movement in this area just yet. Sure, we have lots of experimentation with things like RAI, FEI, algorithmic stablecoins and more - but none really come anywhere close to the same network effects that USDC and USDT have accrued. I believe this is because it’s actually really hard to bootstrap growth of something like a stablecoin as liquidity begets liquidity and (so far) we haven’t seen USDC or USDT have any long-term structural issues (they lose their peg temporarily from time to time, but so do all stablecoins).

Some argue that these centralized stablecoins are an existential risk to Ethereum and that their issuers are now effectively king-makers of the chain. This is because if there is a chain split, Circle (the issuer of USDC) decides which chain’s USDC they will honor which in turn would make the losing chain’s USDC worthless (and thus, much of DeFi would break on that chain). Though I take the other side of this debate and argue that Circle is still beholden to Ethereum’s governance process just like any other actor in the system - just because they are a major player doesn’t necessarily mean that they have any outsized leverage over the ecosystem. You could contrast this with centralized exchanges and argue that they are the real king-makers as they decide which forked chain has the “real” ETH - but again, these entities are still beholden to the same governance process.

I could probably write about stablecoins for hours as it’s such an interesting topic - hell, I haven’t even touched on CBCD’s and what they will mean for the stablecoin sector more generally (though I have written about that before here). Though I do know one thing for sure - stablecoins will continue to play a critical role in the crypto ecosystem - we just need to make sure they don’t also lead to its downfall.

Have a great day everyone,

Anthony Sassano

Enjoyed today’s piece? I send out a fresh one every week day - be sure to subscribe to receive it in your inbox!

Join the Daily Gwei Ecosystem

All information presented above is for educational purposes only and should not be taken as investment advice.

Check out LUSD by Liquity. It's a stablecoin backed purely algorithmically by ETH only. It's the best stablecoin out there imo.