My Big Fat Decentralized Protocol - The Daily Gwei #28

Can Ethereum still be secure if the assets built on top of it are more valuable?

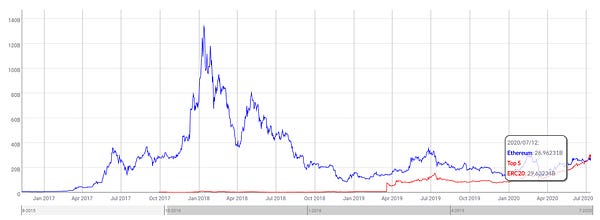

For those that don’t know, the “fat protocol thesis” was put forward by Joel Monegro in August of 2016 and it basically stated that the market cap (or value) of the protocol (in this case, Ethereum) will grow faster and be worth more than the applications built on top of it. Well unfortunately for Joel, that thesis seems to be dying as the total market cap of the top 5 ERC20 tokens is now greater than the market cap of ETH itself.

I was personally never a big fan of the fat protocol thesis (at least, in the Ethereum context) for a few reasons. Firstly, apps that are built on Ethereum are currently parasitic and do not drive any fundamental value to ETH (as I’ve explained in a previous post). They may use ETH as part of their app (as a form of collateral, or as money) but these apps usually have their own native tokens which tend to accrue the value generated by their respective protocols.

Secondly, since I believe that every asset will eventually be tokenized on Ethereum, it makes little sense that ETH would be worth more than every single asset in existence. For example, Apple’s stock (AAPL) could be tokenized on Ethereum today and would have a market cap of $1.66 trillion - 62 times greater than Ethereum’s current market cap.

People tend to speculate that assets being worth more than the protocol securing it makes the chain “unstable” or too “top heavy”. I’m on the fence about if this is really an issue. For example, these AAPL tokens would have no special privilege on the Ethereum network so the main concern really becomes that they act as a “honeypot” for someone to attack the Ethereum chain in order to steal these assets.

Though, in the case of Apple stock, the ultimate settlement layer will always be the off-chain legal system - the token is simply a representation of the stock (just like USDC is a representation of USD sitting in a bank account). And just like USDC, assets like tokenized stock would also have a blacklist function so the only real way the attacker could “cash out” would be to trade the AAPL tokens for another asset on-chain before someone noticed an attack was happening. This would be difficult to pull off though as I imagine that AAPL tokens wouldn’t be freely tradable like other tokens are.

Ideally, the cost to attack the network should always be higher than any potential profit that could be made. With Proof of Work, an attacker would somehow need to gain access to the majority of the networks hash-power (either via gaining access to existing mining pools or by acquiring the mining hardware themselves) to directly attack the chain. Then, depending on what they’re trying to achieve, they’d want to make absolutely sure that attacking the chain is more profitable than just mining the Ethereum network with this hardware.

There are also second-order effects as a result of attacking the Ethereum chain:

The price of ETH could crash (may be able to mitigate this via a short position)

The network will become unstable so the attacker needs to account for that in their profitability calculations

The “social layer” of the network would kick in and possibly roll back the attack (or make an irregular state change like in the case of TheDAO hack)

Since the attack would disrupt real businesses such as exchanges, the attacker may be pursued through the legal system if their identity was discovered

With Ethereum, there are “attacks” happening all of the time on individual smart contracts and these attacks are both easier to engineer and much cheaper to pull off than attacking the entire network. This dynamic, in some funny way, may actually discourage people from ever attacking the Ethereum chain itself.

In saying all of this, there are always going to be actors such as nation states that do not care about profit and may just want to attack the chain in order to destroy it.

As Alfred says - some men just want to watch the world burn.

Have a great day everyone,

Anthony Sassano

All information presented above is for educational purposes only and should not be taken as investment advice.

Follow and Support Me

Donations (sassal.eth and my Gitcoin Grant)

EthHub (ethhub.eth)

Was that a ‘Dark Knight’ quote?