If you’ve been in the Ethereum space for a while, you’ll know all about the concept of “money legos” or “composability” which are basically financial building blocks that are being recreated from the ground up on Ethereum. Each of these building blocks allows for new financial instruments to be built and more rapid innovation to occur.

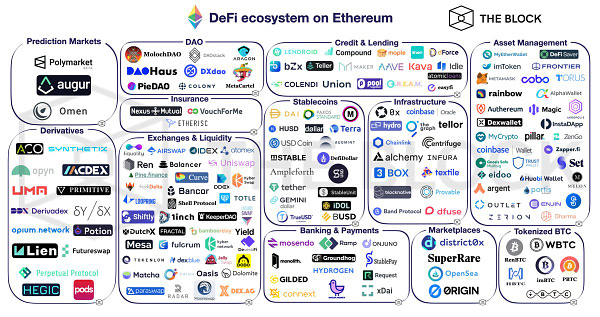

John from The Block posted this great “DeFi map” on Twitter yesterday that really shows the power of these money legos if you know where to look. For example, the decentralized exchanges that have proliferated on Ethereum would have no where near the amount of use/liquidity/volume if stablecoins didn’t exist. This is because stablecoins (like DAI, USDC, USDT etc) are the dominant trading pairs across a range of other tokens because they are, well, stable! Additionally, something like Curve or mStable wouldn’t exist at all if stablecoins weren’t a thing because they are literally stablecoin aggregators. This also means that something like the yETH vault wouldn’t exist either as it relies on Curve to generate the yield - seeing the picture I’m painting here?

Outside of stablecoins, we have other money legos that needed to exist before certain products could gain adoption. 1inch and dex.ag are liquidity aggregators that require other platforms, such as Uniswap and Balancer, to exist and pool liquidity together so that these aggregators can tap into them. Though, no one would care to use aggregators if the on-chain volumes of Uniswap and Balancer were low so these platforms needed not only stablecoins to grow, but assets that people actually want to trade.

Probably my favorite example of the power of these money legos is basically what we’re seeing play out with all of the yield farming. Let’s take the recent yETH vault as an example - here’s the flow: you deposit your ETH into the yETH vault, the vault takes your ETH and puts it into a MakerDAO CDP/Vault, it then draws DAI against this ETH at a 200% collateralization ratio, puts that DAI into the DAI vault on Yearn, this vault puts the DAI into Curve Finance’s Y pool, this pool issues the yCrv liquidity provider token which is then put into the yCRV yearn vault, then this vault puts the yCrv into the Curve DAO to farm CRV, and then later the vault recycles the CRV and trading fees into ETH.

Now try to do something like the above in traditional finance - spoiler alert, you can’t! This is the true power of money legos on Ethereum - unbounded composability, innovation and rapid iteration in order to create financial products that most people have never even dreamed of. DeFi on Ethereum packs 30 years of traditional finance innovation in months and improves upon it in every way. Yes it’s still clunky, expensive to use, full of jargon and has many other issues but it’s already a major improvement over what the traditional system offers.

Have a great day everyone,

Anthony Sassano

All information presented above is for educational purposes only and should not be taken as investment advice.