How the yETH Vault Works - The Daily Gwei #64

Breaking down one of the most popular Ethereum toys.

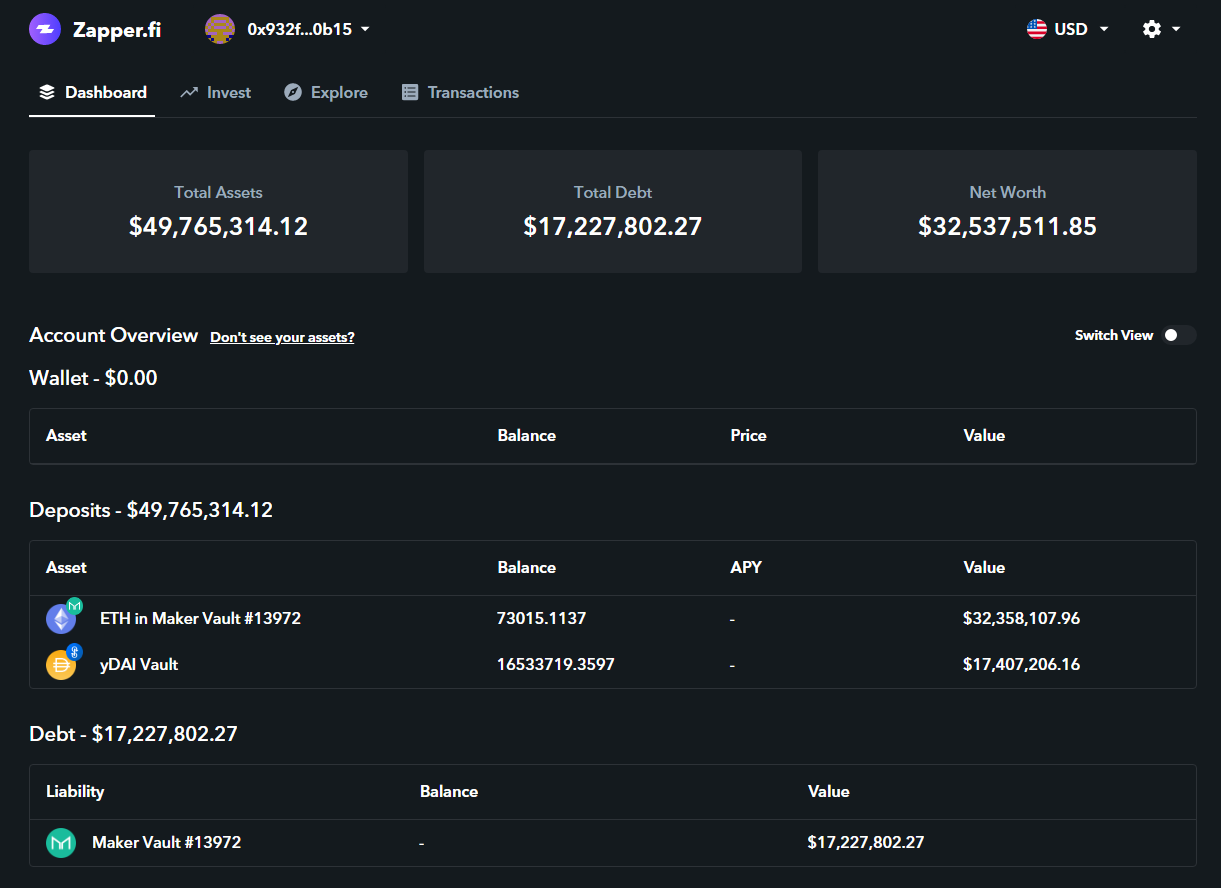

The yETH vault from Yearn.finance launched less than 24 hours ago and it already has over 70,000 ETH locked up in it making it the 7th largest Maker CDP/Vault as measured by ETH locked. This vault is currently earning over 100% APY (minus fees) and is what I like to call a “black hole” for ETH - that is, once ETH goes in, it isn’t likely to come out.

Source: https://zapper.fi/dashboard?address=0x932fc4fd0eee66f22f1e23fba74d7058391c0b15

So, how does it work? It’s pretty simple really - you deposit your ETH or WETH into the yETH or yWETH vault, the vault takes your ETH and puts it into a MakerDAO CDP/Vault, it then draws DAI against this ETH at a 200% collateralization ratio, puts that DAI into Curve Finance’s Y pool in order to farm CRV + trading fees, and then recycles the CRV and trading fees into ETH by buying more of it on the open market. Okay, maybe it isn’t that simple!

Let’s break down each part of what I mentioned above. First, you go to the yearn.finance vaults section here, click on the ETH or WETH vault and deposit your ETH or WETH. For those unaware, WETH is essentially the same thing as ETH but it is “wrapped” which makes WETH conform to the ERC20 token standard (because ETH does not conform to this standard). This makes it easier/cheaper for protocols on Ethereum to interact with it. Once you’ve deposited your ETH or WETH, the yETH vault will automatically deposit it into this MakerDAO CDP/Vault (with everyone else’s ETH). Next, the yETH vault will borrow DAI from this Maker vault and ensure that it stays at a 200% collateralization ratio (to protect it from liquidation in case the price of ETH goes down). Once the yETH vault has this DAI, it will then deposit it into the yDAI vault, then add liquidity to the Curve Finance Y pool which is a stablecoin pool consisting of unequal weights of DAI, USDC, USDT and TUSD (the vault will also be issued yCRV tokens which represent a claim to the stablecoins in this pool). Now the yETH vault is earning trading fees from the Y pool and staking the yCrv tokens on the Curve DAO in order to farm CRV. Periodically, the yETH vault will sell the CRV tokens for ETH on the open market and add that ETH to the vault which increases all yETH holders share.

Okay, hopefully that cleared things up for you! Now, as this is a brand new strategy, it’s always good to go through the risks. The major risk of this strategy is if the MakerDAO Vault/CDP falls to below a 150% collateralization ratio due to ETH’s price falling. This would mean that the yETH vault is open to being liquidated and yETH holders could lose money. If this scenario were to play out, the yETH vault would have 1 hour to pay down the debt in order to bring its collateralization ratio back up above 150%. The reason it has 1 hour to do this is because MakerDAO has a built-in system called the “oracle security module (OSM)” that basically gives CDP/Vault owners 1 hour to pay down their debt. Basically, this means that if ETH suddenly falls from $450 to $350, the yETH vault (or any CDP/Vault) has 1 hour to pay down the debt at the last oracle price ($450) before the Maker oracle updates to $350 (which would put the yETH vault at under a 150% collateralization ratio and it could be liquidated). The nice thing about the yETH vault itself is that it can directly talk to the OSM which means that it knows what the next oracle price will be 1 hour in advance.

Alright, I’ve tried my best to explain this as simply as I can but don’t feel bad if you’re still confused! This sort of stuff takes a bit of time to wrap your head around if you’re not used to the terminology or how these things normally work. Though, the beautiful thing about the yETH vault is that you don’t actually need to understand how it works - you simply deposit your ETH and get instant exposure to over 100% APY (though I would again warn against doing this unless you’re comfortable with the risks).

Have a great day everyone,

Anthony Sassano

All information presented above is for educational purposes only and should not be taken as investment advice.

How can we calculate the price in which ETH would have to fall to liquidate the yETH yearn vault?

Thanks Anthony, so is the black hole analogy because you won’t want to close the vault and get your ETH back due to the great APY, and if you’re long ETH it’s all good, or something else?