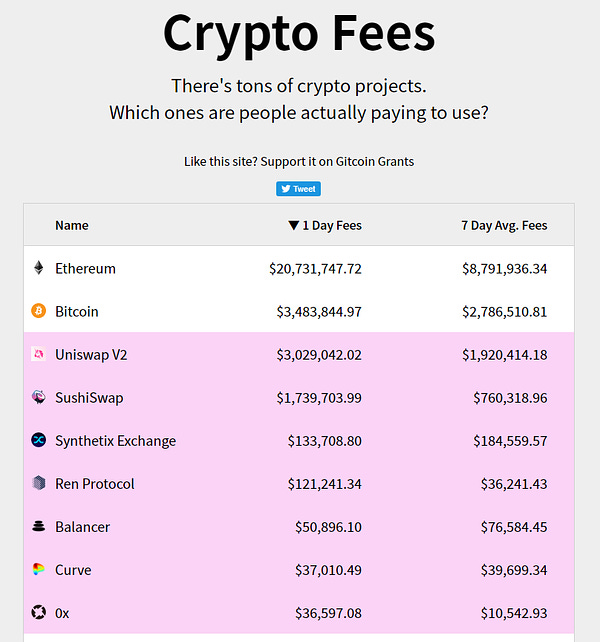

There is more demand to use Ethereum than any other crypto network and on some days the network in second place (Bitcoin) is not even close. As you can see below, due to the crazy high gas prices we all experienced over the last 24 to 48 hours, Ethereum generated $20 million+ in daily fees while Bitcoin only generated $3.5 million.

I know, I know - we all hate the high gas fees and it ruins the Ethereum experience for everyone but the whales who can afford it. In saying that, it is truly amazing to see just how much demand there is to use the Ethereum network as people are still paying the high fees because the transactions that they are doing are worth more to them than even paying $50+ in fees. On Bitcoin, the only real demand for its block space is to move BTC around whereas on Ethereum moving ETH around is simply one of many, many use-cases. Also, because of how the Ethereum gas mechanism works, different transactions cost different amounts in fees (and things like deploying smart contracts can cost thousands of dollars in fees).

I’ve argued in the past on why I believe high fees are actually a good thing over the short to medium term and the summary of those arguments is that it basically forces the adoption of layer 2 which is exactly what’s happened over the last few months and will continue to happen into 2021. All it’s going to take is a few key players like Uniswap to migrate and then it’ll be a snowball effect from there. Though, there are already plenty of apps on layer 2 that you can play around with and I listed those in this tweet here.

Now just imagine if we had EIP-1559 live on the network and some amount of these fees were being burned instead of being paid out to miners. This would cause deflationary pressure on ETH and offset some of the block rewards being paid out to miners (who are currently making more money than anyone). On top of this, the Ethereum network could one day be processing so much economic activity that the fees burned could actually cause ETH’s yearly issuance to go negative which would greatly increase the scarcity of ETH and create a symbiotic relationship between all network users.

I know we’re all hurting lately because we’re forced to delay a lot of our Ethereum activity (or pay the high fees) until gas prices come down but I believe this short-term pain will be worth it. Soon enough, end-users like us won’t have to experience high fees and slow transactions and our economic activity will be mainly done on layer 2 with layer 1 Ethereum offering strong settlement and security guarantees. Oh and while you’re waiting, try not to check this website too much - it can be quite depressing!

Have a great day everyone,

Anthony Sassano

Join the Daily Gwei Ecosystem

All information presented above is for educational purposes only and should not be taken as investment advice.