Dude, Where's My ETH? - The Daily Gwei #269

Tracking where all the ETH in smart contracts actually lives.

Note: I was going to include URL’s to all of the addresses that I referenced in this piece but unfortunately Substack apparently blocks Etherscan links now - sorry for the inconvenience!

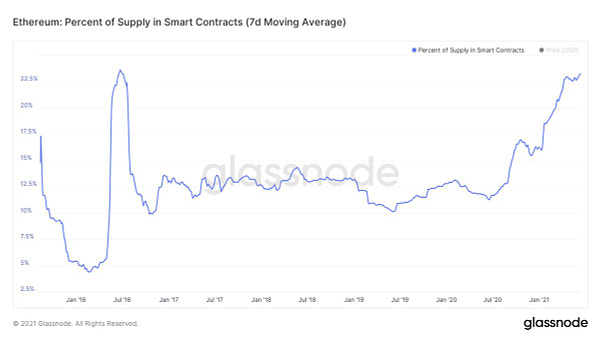

At this point you’re all probably well aware of the fact that more and more ETH has been leaving centralized exchanges and heading into things like DeFi (I wrote about that here). As it currently stands, 23% of all ETH is deposited into smart contracts which is around the same level it was during the infamous ‘The DAO’ event. Though there’s a key difference here - 23% of the total ETH supply was much less in June of 2016 (16.3 million ETH) than what it is today on Ethereum (26.45 million ETH).

So you may be wondering: what smart contracts is all of this ETH being deposited into? Well, the most obvious answer is that a large chunk of it (around 9 million ETH) is being put to work within DeFi. Then we can count the amount of ETH in the eth2 deposit contract (around 5.5 million) which gives us a total of 14.5 million ETH across DeFi and staking in eth2. But what about the other 12 million ETH? Well the breakdown is as follows:

Gemini holds 2 million ETH here and here

1.7 million ETH is in the Gnosis Safe multi-sig wallet

950,000 ETH is in the Polygon bridge

400,000 ETH is in the Ethereum Foundation’s developer account

Vitalik holds 325,000 ETH in one of his cold wallets

306,000 ETH lies dormant in the Polkadot multi-sig (it can’t ever be retrieved due to a bug)

181,000 ETH sits in Tornado.Cash smart contracts

This all totals 5.78 million which brings us to 20.27 million ETH which still leaves 6.18 million ETH unaccounted for. From what I can tell, there’s a bunch of ETH (probably over 500,000) sitting in ICO treasuries, there are many unlabelled smart contracts with 300,000+ ETH in them, there are layer 2 solutions that have tens of thousands of ETH and finally I suspect that the BSC bridge contract probably has close to 1 million ETH sitting in it. Additionally, the wrapped ETH (WETH) smart contract has 6.33 million ETH in it but I omitted it because I suspect almost all of that WETH is deposited into DeFi contracts anyway.

Now let’s look at the dollar amounts and the distribution. As mentioned in my tweet above, 23% of all ETH in June of 2016 was only worth $230 million whereas today 23% of all ETH is worth an astonishing $63 billion - this represents a 273x increase. According to my research, 11.5 million ETH was deposited into The DAO before it was exploited which represents ~70% of the total ETH in smart contracts at that time. Today, the most dominant single smart contract (besides WETH) is the eth2 deposit contract (at 5.5 million ETH) which represents only ~21% of the total ETH in smart contracts - a dramatic improvement.

Thinking back to the early days of DeFi I remember that Maker was the most dominant app by far as measured by TVL - holding over 95% dominance for a while - but that dominance has since come down considerably (under 15%) and Maker isn’t even the top DeFi app measured by TVL anymore - that crown currently belongs to Aave. I expect the same thing to keep happening with ETH in smart contracts - eventually no contract will hold more than 5% of the ETH supply because there will just be a universe of different things to do with your ETH (though I’d probably exclude the deposit contract here - that thing could end up eating a whole lot of ETH eventually).

Have a great day everyone,

Anthony Sassano

Join the Daily Gwei Ecosystem

All information presented above is for educational purposes only and should not be taken as investment advice.

Legendary title...