ETH is Coming Home - The Daily Gwei #243

Taking power away from centralized exchanges 1 ETH at a time.

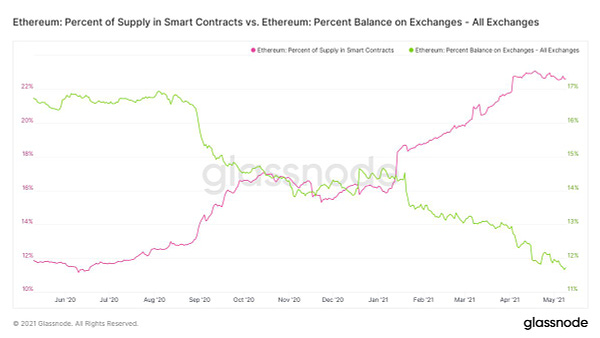

As I stated in my tweet below, this chart is my favorite chart in crypto because it paints a very clear picture of the paradigm shift that is currently happening - that is, centralized finance (CeFi) institutions are slowly losing their power and dominance to DeFi.

Now, the chart above is simply a measure of how much ETH is sitting on centralized exchanges vs ETH being held by smart contracts and there’s a lot of nuance to add into all of that. This is because ETH can go into smart contracts for a number of reasons and for a number of different use-cases - it doesn’t necessarily mean that the ETH is “locked” or not able to be freely sold back into the market. Below, I’ll run through what some of these reasons and use-cases are so that you’ll have a clearer picture of how to evaluate the above metric going forward.

Let’s first take a look at staking in eth2 and how it plays into this. All ETH needs to be sent to the “deposit contract” before it can be staked so that ETH is counted in the above metric (and it’s currently sitting at 4.4 million ETH). Most of this ETH can be considered “locked” because its a one-way bridge into staking at the moment (though there are staking derivatives live today like Lido). The ETH sent into staking is effectively removed from the market until the eth1 <> eth2 merge happens and even then, I don’t personally expect much ETH to flow out of staking (and there will probably be a lot more than 4.4 million ETH in the deposit contract before the merge).

Next up we have all the ETH that is used within DeFi which is currently sitting at around 10.2 million. Of this ETH, around 6.6 million is currently in “money market” protocols such as Maker, Aave, Compound and Liquity which means it’s being used as collateral and not actively traded. A further ~2.4 million ETH is being used in AMM’s as a pairing asset which means some of it is being actively traded (most of this ETH actually sits idle in non Uniswap v3 AMM’s). Though as Cyrus points out, a lot of this ETH is only in AMMs to liquidity mine/yield farm and when it gets removed it can cause a “sell-side liquidity crisis” (though more data is needed here).

Finally we have ETH that is being stored in smart contract wallets aka “cold storage” of which the most popular is the Gnosis Safe (which currently holds 1.8 million ETH). This ETH isn’t locked or “frozen” in place but it does give us a good idea of how much ETH is just sitting idle. Using this data, we can easily track the flows of these wallets to centralized exchanges for signals of incoming drops in price due to selling (though in the past these signals have resulted in a lot of false positives). As usual, we need more data!

There’s sometimes a debate that I see on Twitter about whether ETH flowing into smart contracts is actually bullish or bearish for the price but I think this is the wrong question to ask. To me, it’s all about what the ETH is actually being used for and if the utility of Ethereum is driving demand for more ETH (I believe that it clearly is). On top of this, demand for ETH also comes from speculators and investors and much of this ETH sits in exchange cold storage wallets (many of which aren’t smart contract wallets). All in all, it’s just good to see ETH being brought “home” into wallets individuals actually control instead of wallets that centralized exchanges control. After all, we’re here to go bankless.

Have a great day everyone,

Anthony Sassano

Join the Daily Gwei Ecosystem

All information presented above is for educational purposes only and should not be taken as investment advice.