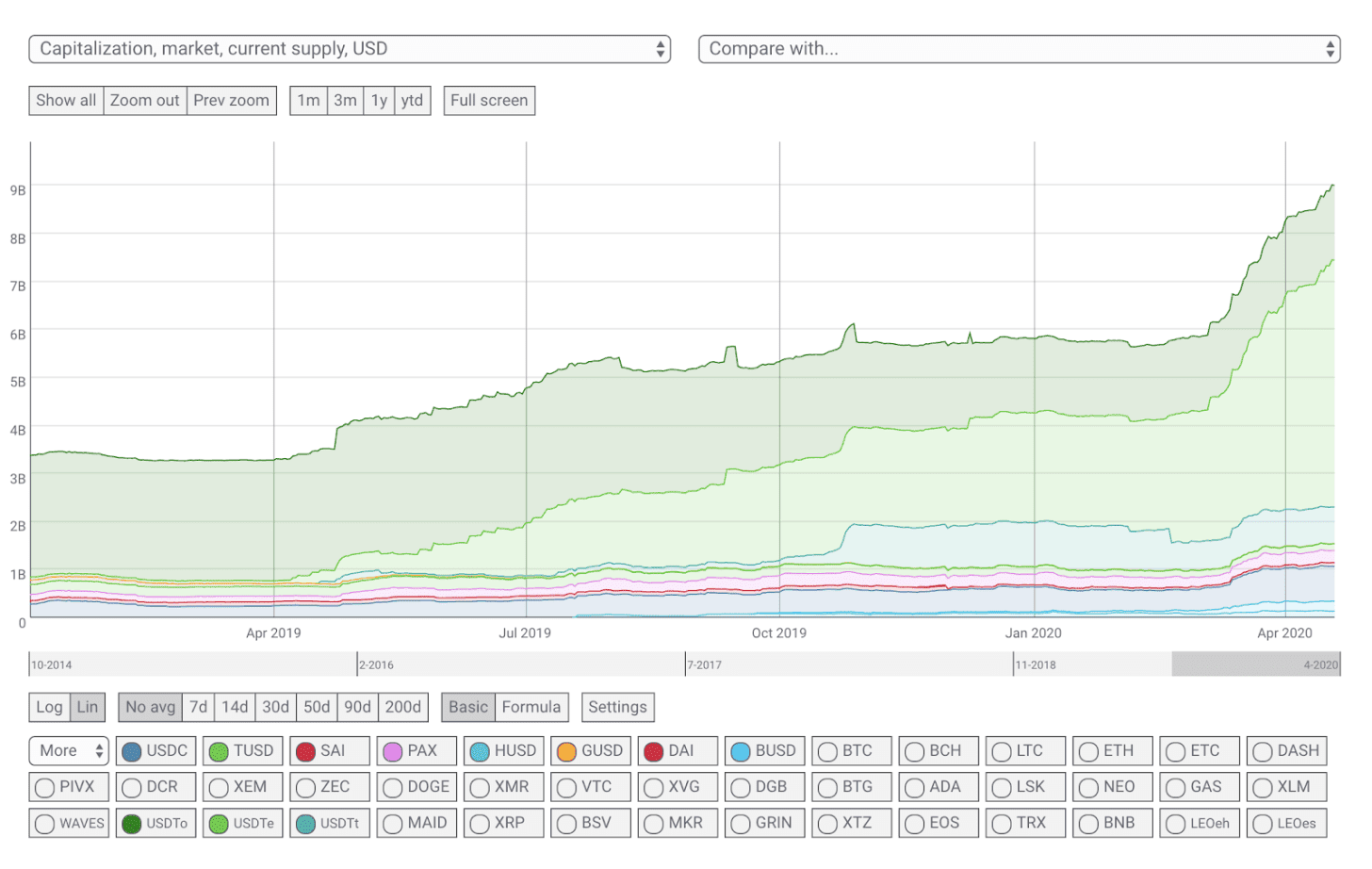

Since about February/March of this year, Tether (USDT) growth has exploded and is currently sitting at an all time high market cap of - dwarfing every other stablecoin on Ethereum and more than 10x larger than it’s closest competitor (USDC).

Source: https://coinmetrics.io/

This growth has led many in the Ethereum community to begin questioning if this is what we really want DeFi to become - that is, a decentralized financial system dominated by a centralized asset that is surrounded in secrecy. For those unaware, Tether has been the subject of heavy criticism for many years because there has never been a way to actually audit that USDT is backed 1 to 1 by USD in a bank account. This is unlike stablecoins such as USDC which is fully regulated with monthly audit reports and DAI which can be audited entirely on-chain. Tether has also been the subject of high-profile lawsuits and scrutiny from the NYAG. To make things even worse, Tether’s lawyer themselves claimed back in August of 2019 that USDT was only backed by 74% in cash and other assets. Though, to be a little fair here, I would suggest that you listen to this excellent podcast episode with Dan Matuszewski of CMS Holdings as he gives us a peak behind the very thick curtain that is Tether.

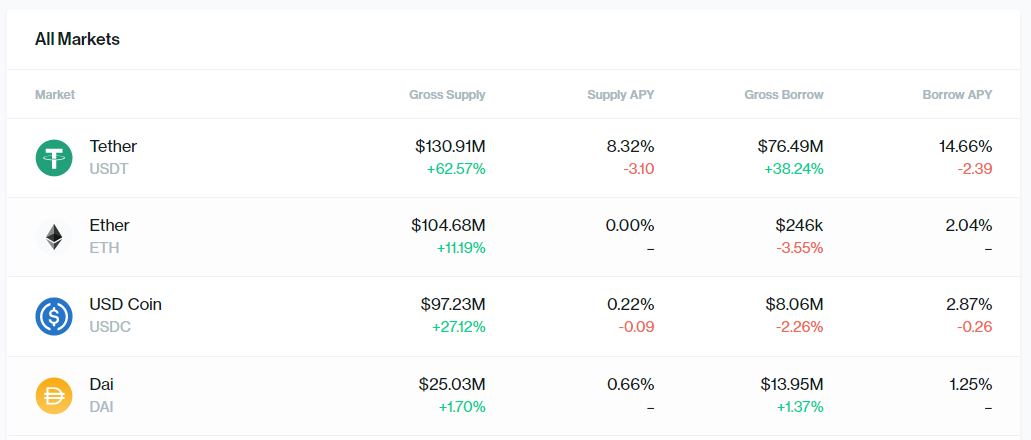

Okay, no need to dwell on the amount of shadiness involved with USDT. Let’s discuss how this can materially impact the DeFi movement. For starters, it’s already having a massive effect on platforms like Compound with the beginning of their liquidity mining program which has pushed USDT to become the dominant collateral on the platform (even beating out ETH).

What does this mean in practice? Well basically, if Tether (the company) decided to, they could instantly freeze $130 million worth of collateral inside Compound which would be catastrophic for the platform. USDT could also permanently lose its peg to the U.S. dollar for a number of reasons or Tether could even be shut down by regulators. The common denominator here is that USDT is very risky and probably not something we should be embracing in DeFi but alas, liquidity begets liquidity and USDT is unbeaten in that arena.

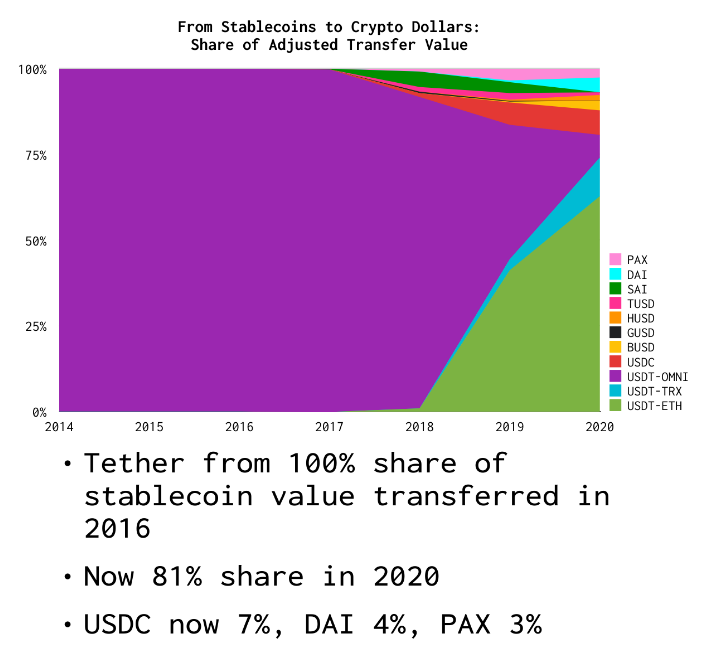

This chart in particular from Blocknative’s stablecoin report lays bare just how dominant USDT has been on every chain that it’s been on since 2014. You can also see how it very quickly became the dominant stablecoin on Ethereum once it migrated over and it has stayed that way to this day. Though, the one positive here is that transfer value for USDC (7%) and even DAI (4%) is not negligible but it still pales in comparison to USDT’s 81% share.

So how do we improve the situation? Well for starters, we need to be embracing and pushing the adoption of other, more decentralized stablecoins. The obvious choice here is DAI but even that has come under heavy scrutiny lately as MKR holders have voted to add in centralized assets as collateral such as WBTC and USDC (even though DAI is still backed predominantly by ETH). There’s also the issue with DAI in that it has scaling troubles because it is capital intensive to generate - if you want trustless DAI, you need to post 150% of collateral in ETH. Finally, DAI constantly has issues with its peg to the U.S. dollar).

Okay, so what about the other stablecoins? Well there really aren’t any other decentralized stablecoins that are big enough to service the needs of users yet. Projects such as mStable are aiming to create a stablecoin backed by a basket of other stablecoins but it is very new and its market cap is tiny. Other projects such as MetaCoin are attempting to directly challenge MakerDAO and DAI but it’s not even live yet. There are synthetic dollars such as sUSD from Synthetix but again, it’s small and is part of a system that is still quite centralized (by design). I’m not going to cover every project today but I thought I’d just give you an idea of where we currently are.

I’ll personally keep pushing the decentralized alternatives as much as I can but I’ll also be recommending USDC over USDT as I believe that if people want to play with a centralized stablecoin, it should at least be one that we can be sure is actually backed by real fiat and not just created out of a money printer.

Have a great day everyone!

All information presented above is for educational purposes only and should not be taken as investment advice.

Disclaimer: I am currently serving as an advisor to mStable and I’m also an investor in the project.

Interesting view on Tether- thanks for that. Size and success of a large market cap attracts attention - so regulation sounds like a risk. Non transparency really erodes confidence, so I agree, a few big issues there- I’ve heard the phrase, ‘too big to fail’ before :)