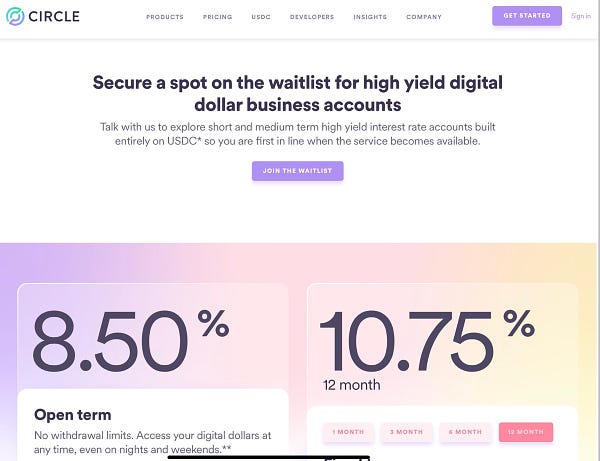

Over the next few months lots of people are going to begin to discover that they can earn 10%+ on their USD instead of letting it sit in a bank account earning <1%. CeFi is perfectly positioned to serve these customers as an “interface layer” for the various DeFi apps that offer these yields and that is exactly what Circle (the creators of USDC) will be doing with their new ‘High Yield Digital Dollar Accounts’.

Circle isn’t the only player getting into this game - Coinbase have also had portals into DeFi on their web and mobile apps for a little while now. On their mobile wallet app, they have a line item that says ‘Earn interest on your crypto’ with an APR % and once you click into it and select which currency you want to earn a yield from, it gives you a choice between 2 DeFi protocols - Compound and dYdX.

We’re also seeing lots of centralized services participating in DeFi yield farming with their own funds and sometimes their customers deposits. Celsius is one service that has been doing this in a big way and they’re also staking in eth2 (along with Kraken and other exchanges). Other centralized players such as market makers and OTC desks are also playing in DeFi through contributing liquidity and acting as a front-door for their customer bases (not everyone wants to get into the weeds of DeFi themselves).

As I’ve described before, Ethereum is an economic nexus that sucks in financial activity from wherever it can find it. It is the world’s most versatile, efficient and exciting financial system that operates completely in cyber-space and never has any downtime. Though, DeFi is only at $15 billion locked today which is basically a rounding error for the traditional financial system but I think this is going to change dramatically over the next few years as more centralized players discover how to tap into this new system and add value to it.

The best thing about all of this is that even though centralized players are going to basically have a large moat with front-ends for DeFi, no one is forced to use them because the back-end infrastructure is neutral! So, for example, you could choose to use Coinbase’s savings account and store your funds with them or go directly to the source and put your funds into yEarn to yield farm on your own - this optionality is what makes DeFi so powerful!

I believe that every centralized exchange or service will have to create an interface layer into DeFi for their customers or risk being beaten by those who do. This will lead to a further supercharging of the liquidity vortex that is Ethereum which just reinforces Ethereum’s network effects and use as a global settlement layer. To dive deeper on this topic, check out Bankless’ ‘Protocol Sink Thesis’ here.

Have a great day everyone,

Anthony Sassano

Join the Daily Gwei Ecosystem

All information presented above is for educational purposes only and should not be taken as investment advice.