“First they ignore you, then they laugh at you, then they fight you, then you win.”

It’s no secret that DeFi has been growing at an incredible pace over the last few months after years of quiet but continuous building. By definition, DeFi has always been at war with CeFi but after what I’ve seen over the last couple of days, I can confidently say that we are currently in the “then the fight you” stage of this war - and it’s about to get bloody.

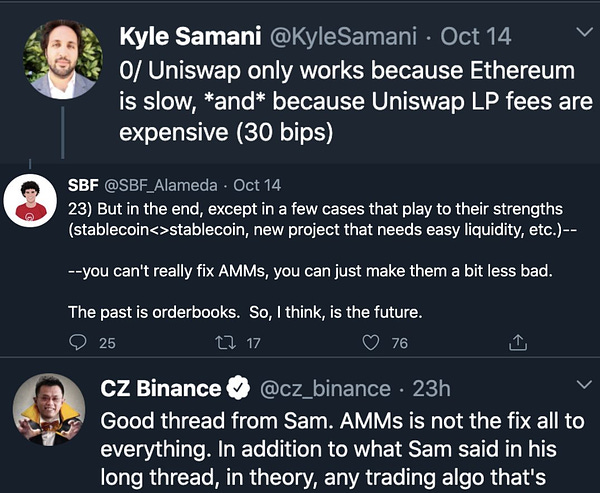

If you’ve been following the conversations on Twitter over the last couple of days you’ll be familiar with what I’m going to write about today but for those who aren’t, here’s a short recap. Basically, lots of people have been debating the advantages/disadvantages of different exchange models - namely AMM’s (like Uniswap) vs CLOB’s (traditional order book exchanges). Of course, centralized exchange operators like SBF from FTX and CZ from Binance are defending the traditional order book model because that is what their entire business relies upon (and they profit more from the use of CLOB’s over AMM’s). On the other hand, the Ethereum community is defending AMM’s because the most popular decentralized exchanges use this model, it levels the playing field for regular users (anyone can liquidity provide on AMM DEXs) and it disrupts the CLOB models that centralized incumbents love.

The fear that centralized exchange/service providers are feeling right now is on full and obvious display. Previously, DeFi must’ve seemed like a toy to them - something that wasn’t even worth thinking about but that all changed over the last few months with the explosive growth of DeFi and, more specifically, Uniswap. As you can see from the tweet above, Uniswap did more volume than one of the largest centralized exchanges in the month of September and this is with all of the current drawbacks of Ethereum (lack of scalability, high gas fees, clunkier UI/UX for new users). There is real and lasting demand for AMM exchanges - even without yield farming incentives - and even the mainstream world is taking notice.

We’re going to continue seeing this lashing out from centralized operators as their businesses continue to be disrupted by the zero to one innovation that is DeFi. Some will try to “compete” as CZ has attempted to do with Binance Smart Chain (or what he likes to call “CeDeFi”) and like what SBF is trying to do with Serum (his not-actually-decentralized exchange). I believe the best bet for CeFi at this stage is to just become an interface layer for Ethereum DeFi protocols - that way, centralized services can still serve a wide range of customers and monetize at the user/interface layer - they just won’t be able to control the underlying exchange architecture anymore (which really annoys them). Honestly, the growth of DeFi and the disruption of CEXs happened way faster than I thought it would but I think it speaks to just how fast developers can innovate on Ethereum - especially when they put the money legos on Ethereum to work.

So, in closing, I have just 1 simple message for the centralized incumbents: DeFi is here to disrupt every single one of you and we’re coming at you with everything we’ve got - prepare yourselves.

Have a great weekend everyone,

Anthony Sassano

All information presented above is for educational purposes only and should not be taken as investment advice.

Was revisiting Serum and remembered your comment here "his not-actually-decentralized exchange". Was wondering what that is based upon?

I am not a Serum fan. Just trying to understand it more.

From Crypto Briefing:

"The DEX will run on a central limit orderbook, but will still operate in a trustless manner."

From The Tie:

"These order books aren’t centrally controlled, they are fully programmatic as they automatically match orders between third party users through the use of smart contracts."

So could it be that, yes there is a 'central' orderbook, but it is not centralized and is actually trustless?

Was revisiting Serum and remembered your comment here "his not-actually-decentralized exchange". Was wondering what that is based upon?

I am not a Serum fan. Just trying to understand it more.

From Crypto Briefing:

"The DEX will run on a central limit orderbook, but will still operate in a trustless manner."

From The Tie:

"These order books aren’t centrally controlled, they are fully programmatic as they automatically match orders between third party users through the use of smart contracts."

So could it be that, yes there is a 'central' orderbook, but it is not centralized and is actually trustless?