A Lesson in Pumpamentals - The Daily Gwei #13

If you’d like to support my on-going work to bring you a fresh Ethereum-packed newsletter every week day, feel free to make a donation on Gitcoin here (during the current matching round a 1 DAI donation is currently being matched on my grant by 29 DAI)!

A little note before we dive in - I thought I’d do something fun today and write about the recent price action with COMP and the concept of “pumpamentals”. It should go without saying that none of what I write below should be taken as investment advice - I’m simply recapping the events of COMP’s launch in jest. This post is also not a dig at Compound, rather, it’s a compliment and testament to what I consider a genius token distribution mechanism.

Alright, let’s go!

So you want to pump your token? Well, strap right in - I’ll be your friendly guide to the wonderful world of pumpamentals! Today, we’re going to use the recent COMP token launch as a case study.

Source: https://uniswap.vision/?ticker=UniswapV2:COMPETH&interval=240

Look at that price action on COMP - a roughly 8x increase against ETH since it started trading. You want that to be your token, don’t you? Of course you do! Well before your token can pump, you need to make absolutely sure that you create hype and fomo for it.

How do you do this? Well first, you need to restrict the supply so that the price doesn’t just keep dumping. Compound achieved this by implementing a vesting schedule for ~22% of the tokens (founders & team), reserved ~12% of the tokens for future team members/community (essentially locked at this stage) and the protocol is distributing ~41% of the tokens over 4 years via their innovative “liquidity mining” program.

Finally, you want to make sure that the ~24% of tokens that were distributed to your original shareholders aren’t just dumped on the market from the get go. Note here: I don’t actually know what happened with these tokens but from the on-chain data I’ve seen most (if not all) of these tokens have not been sold yet. This signals to me that there may have been either an agreement in place stating not to sell these tokens or the investors are smart enough to wait for a deeper market to emerge (so they don’t move the price too much).

The critical part of this whole design is the liquidity mining program - this is what creates the real fomo and gets the DeFi juices flowing but it only works if you restrict the supply of tokens so that the master plan can be executed. For Compound, the only tokens known to have been on the market before the program launched were put into a Uniswap pool (initially 25,000 COMP tokens or 0.25% of the total 10 million supply and 2,000 ETH) at a starting price of ~$18.40. A whale then immediately bought a lot of COMP pushing the price up to ~$48 (which then shot up to ~$96 shortly after).

So, now we get to the Compound Master Plan™:

Create a relatively illiquid Uniswap market before the liquidity mining program goes live (and count on early buyers to drive the price up)

Launch the mining program with extremely limited new supply emission (~2880 per day) as not to crash the price on Uniswap

Grow the protocols assets locked as fast as possible. Compound achieved this by tapping into the most liquid asset on Ethereum - good old Tether (USDT)

Once the USDT machine is roaring and driving the total value locked (TVL) of the protocol to new highs, it’s important that the price of COMP also keeps increasing so that it incentives people to put new assets into the platform in order to mine COMP

This is when Coinbase comes in and announces that they’ll be listing COMP - this immediately pumps the price from ~$50 to $150+

Now the fomo really kicks into high gear - everyone is talking about Compound and “yield farming” so they continue to plow their assets in to get those sweet COMP payouts

Speculators will now also continue buying up COMP to play the impending “Coinbase Pump”

Finally, the Master Plan succeeds and Compound becomes the first project in DeFi history to flip MakerDAO in TVL on DeFi Pulse leading to even greater awareness

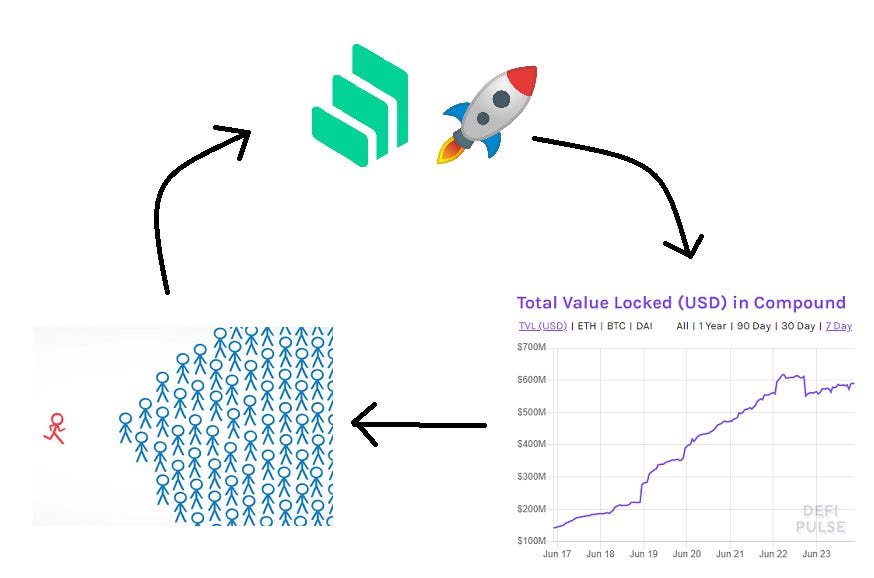

All of this culminates into a viral fomo loop: COMP price goes up > TVL for Compound increases > awareness/hype/fomo increases > COMP price goes up.

Took me 5 minutes to create that beauty in Microsoft Paint.

This is peak pumpamentals and what I like to call beautiful mechanism design. The entire system was created to maximize both hype and fomo in a way that actually grew the underlying platforms use. I applaud the Compound team for what they’ve done here and I can’t wait to see how other teams structure their own liquidity mining programs.

And always remember kids, don’t forget to pump it.

Have a great day everyone!

All information presented above is for educational purposes only and should not be taken as investment advice.

Follow and Support Me

Donations (sassal.eth and my Gitcoin Grant)

EthHub (ethhub.eth)