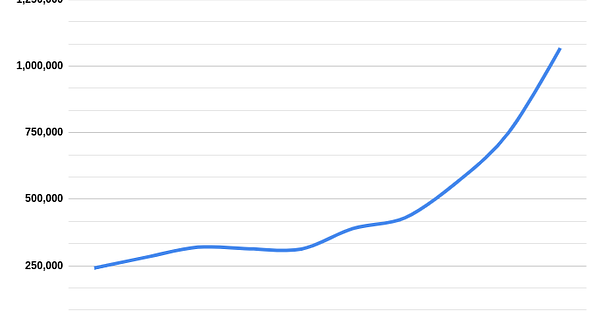

Yesterday, MetaMask announced that they had exceeded 1 million monthly active users of their desktop and mobile Ethereum wallets. This number is probably the best measure we have of real and non-duplicate users of the Ethereum chain. But, if this wasn’t enough for you, The Graph also tweeted about how their hosted service processed over 7.6 billion queries in September which represents an ~80% MoM growth. I covered why tracking The Graph’s growth is important in this piece.

So to anyone paying attention these metrics probably aren’t a shock to you given the explosive growth we’ve seen across the DeFi sector over the last few months. Though, it’s actually very difficult to measure the real user numbers since a user can have multiple addresses that they use to interact with apps on-chain (and many do). That’s why MetaMask’s numbers are so important - the number of people who would have duplicate MetaMask accounts that they are actively using each month is probably very low. On top of this, even if we say that a user is actively using both the desktop and mobile versions of MetaMask, we would still get a number of 500,000 monthly active users.

Now, what are these users doing? Unfortunately MetaMask’s post doesn’t go into too much detail about this but obviously September was a very big month for DeFi in particular - both for usage and DeFi token prices. We saw this play out with many DeFi tokens posting insane returns and the mini-trend of “Uniswap gems” dominating the scene. On top of this, we had one of the biggest (if not the biggest) on-chain events happen in September - the UNI airdrop which was claimed by over 140,000 addresses.

I’d also attribute a lot of this user growth to the explosion of the NFT (non-fungible token) scene which has seen a renaissance of sorts over the last couple of months. I believe if anything is going to bring in new, non-speculative driven users, it’s going to be things like in-game items, digital art and collectibles. From what I’ve seen, these communities don’t actually use DeFi very heavily - they may just Uniswap to trade their NFTs or another platform like OpenSea or Rarible but they don’t seem to be very interested in speculating on random “Uniswap gems” or going leverage long on ETH. I think this speaks to the diversity of what Ethereum can offer as the platform is not just locked down to one particular use-case.

This level of activity on Ethereum is even greater than the activity on the Bitcoin network and greater than the combined activity of every other layer 1 protocol which is exactly why I believe that Ethereum has already won. Now, that’s not to say that other platforms won’t exist as a “sidechain” to Ethereum but I’m certain that Ethereum will remain the economic nexus at the center of all crypto-related activity.

Have a great day everyone,

Anthony Sassano

All information presented above is for educational purposes only and should not be taken as investment advice.