We Accidentally Broke It - The Daily Gwei #16

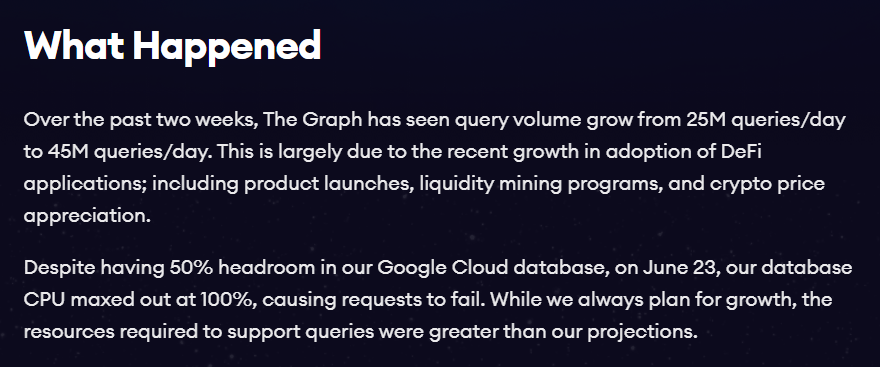

It’s no secret that Ethereum and DeFi have seen explosive growth over the last few months but the last 2-3 weeks have taken it to a whole new level. Usage of various apps has grown so much that it put too much pressure on one of the major infrastructure providers on Ethereum (The Graph) causing the apps it supports to suffer degraded performance.

A snippet from The Graph’s post-mortem: https://thegraph.com/blog/outage-post-mortem

For those that are unaware, The Graph (aka Graph Protocol) are building a decentralized query layer for blockchains - starting with Ethereum. This is critical infrastructure for many projects in the Ethereum/DeFi space but you may have had no idea what it even was until recently because it’s all in the back-end.

An easy way to explain it is that instead of project team needing to spin up their own infrastructure to run their app (in the form of full and archive nodes for Ethereum), they can opt to use a third-party like Infura and Alchemy. In fact, when you select ‘Main Ethereum Network’ in MetaMask, you’re using Infura’s infrastructure to talk to the Ethereum mainnet! The Graph is a third-party that sits on top of the nodes that Infura and Alchemy run. The key difference with The Graph is that they are trying to build a decentralized query layer instead of a centralized one (it’s worth mentioning that it’s centralized in it’s current form).

The broader point I wanted to talk to in this piece is the intense growth that we’re seeing in Ethereum lately. It feels like there’s been a momentum shift with the meme of “yield farming” capturing not only the attention of the existing Ethereum community but also bringing in lots of brand new users (as evidenced by The Graph’s downtime). I’m even noticing many Bitcoiners moving their BTC to Ethereum to try out DeFi with tokenized BTC on Ethereum at almost at $100 million!

We all know that gas usage has been at all time highs for months now but there is one other key indicator that I like to use to measure the growth of the network - daily active addresses (based on a 7 day moving average). This metric has been trending up since the start of the year and is currently at its highest level since July 2018.

Source: https://studio.glassnode.com/metrics?a=ETH&m=addresses.ActiveCount&mAvg=7&zoom=all

All of this sustained growth has me seriously wondering if we’re in the second half of 2016 in terms of the “market cycle” of crypto. Ryan Sean Adams has written about this before here, but I want to expand on this with some narratives that I’m seeing that remind me of those from 2016 (post DAO hack).

2016 narrative <> 2020 narrative:

TheDAO and ICOs <> Liquidity mining/yield farming

“Blockchain not Bitcoin” <> “Ethereum not ETH”

“Ethereum has failed” <> “Will ETH accrue value?”

“Ethereum is getting DoS’d” <> “Ethereum is unusable due to high gas fees”

Notice a pattern here? The negative narratives from 2016 didn’t matter in the end - ETH went on to increase in adoption and greatly increase in price during 2017. I suspect that we’re very close to repeating this same pattern over the next few months as each of the new negative narratives begin to break down (as I very much expect they will).

History doesn’t repeat itself, but it often rhymes.

Have a great weekend everyone!

If you’d like to support my on-going work to bring you a fresh Ethereum-packed newsletter every week day, feel free to make a donation on Gitcoin here (during the current matching round a 1 DAI donation is currently being matched on my grant by 41 DAI)!

All information presented above is for educational purposes only and should not be taken as investment advice.

Follow and Support Me

Donations (sassal.eth and my Gitcoin Grant)

EthHub (ethhub.eth)