Unstable Coins - The Daily Gwei #274

Can the crypto ecosystem lessen its reliance on the almighty USDT?

Stablecoins have been around for a while in crypto and they started all the way back in July of 2014 with Tether (USDT) which was actually known as ‘RealCoin’ back then. Since then, the number of stablecoins in existence has exploded with the more popular ones like USDT, USDC, BUSD and DAI achieving many billions of dollars in market cap. Though it’s not all sunshine and roses - there has been a lot of criticism of stablecoins over the years - especially USDT - so let’s dive into that a bit today.

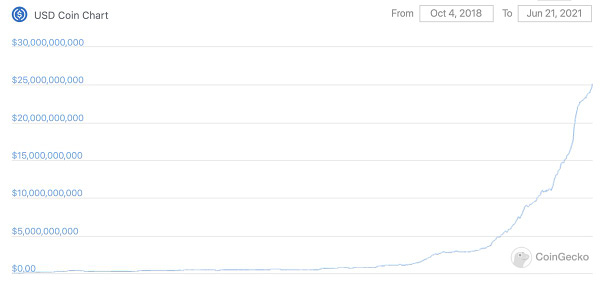

I won’t give a run-down of all the concerns people have brought up with USDT over the years - instead, I wanted to talk about how the crypto industries reliance on USDT has been waning for some time now. Now, of course, USDT is still massive with a $62 billion market cap and has done ~$25.6 billion worth of volume over the last 24 hours but stablecoins like USDC and BUSD are catching up. USDC currently has a market cap of $25 billion and BUSD is sitting at around $5.3 billion. Though USDT still absolutely dominates in trading volumes as USDC has only done $2.2 billion over the last 24 hours and BUSD has done $5.3 billion. The network effects of USDT’s liquidity are immense.

Now let’s look at how the “decentralized” alternatives are fairing. Well, DAI been growing, albeit a lot more slowly (since DAI minters have to overcollateralize). Unfortunately, DAI has also suffered from the fact that it is now backed by around 50% of USDC which means it can’t really be called a truly decentralized stablecoin at this point in time. And from what I can tell, USDC collateralization (coupled with the ‘peg stability module’) is a major reason why DAI has actually been able to keep its peg so removing USDC would probably just leave DAI even worse off - rock and a hard place!

I’ve written about what I think the “holy grail” of stablecoins looks like before but unfortunately I still don’t think we are there yet. There have also been plenty of “algorithmic stablecoin” experiments playing out over the last year or so but almost all of them have either exploded spectacularly or aren’t actually able to keep their peg (so basically not a stablecoin at all). Though these things tend to be very lucrative “money games” for early participants which means some of them did well during the peaks of the bull market. Though to be clear here by “did well” I mean that it made the early participants a lot of money (there’s a term to describe this… rhymes with ‘fonzy’).

Anyway, I personally hope that these centralized stablecoins lose most of their dominance to something that is truly decentralized but honestly, that’s going to take a very long time. On top of that, we don’t even have any truly decentralized stablecoins in the ecosystem right now (and certainly none that are widely adopted) so we need to work on that first before we take on the world. But as always, I’m betting on the Ethereum ecosystem of builders to figure this out - let’s see if they can!

Have a great day everyone,

Anthony Sassano

If you’d like to support my on-going work to bring you a fresh Ethereum-packed newsletter every week day, feel free to make a donation on Gitcoin here (the donation will be matched quadratically during the current matching round).

Join the Daily Gwei Ecosystem

All information presented above is for educational purposes only and should not be taken as investment advice.