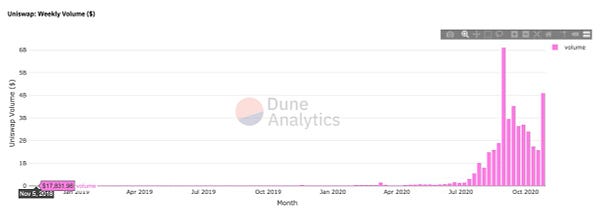

It’s November 3rd (for most of the world) which means Uniswap turned 2 years old today and what an incredible 2 years it has been for the protocol. As you can see below, Uniswap’s first week of trading had a mere $17,000 worth of volume - 2 years later, that’s now in the billions every week.

Uniswap is one of the original DeFi projects born in the depths of the worst bear market crypto had ever seen with ETH trading at $200 after peaking at $1400 just 10 months earlier. About 6 weeks later, ETH was trading in the double digits again (around $80) and no one knew where the bottom was. All throughout this bear market action, the builders didn’t stop building and in 2020, we’re seeing the results of their labor on full display.

I’m sure you’ve all seen how Uniswap has been doing more volume than centralized exchanges over the last couple of months (including major ones like Coinbase) but I want to contextualize just how big of a deal this is. Coinbase is a very large organization that has been around for many years - it has 1,200 employees and offers a range of services (not just trading) and is also the “front door” of crypto for many people in the states. Now, let’s take Uniswap (the company) - they have 10-15 employees at any given time and their main product is of course the Uniswap protocol which is the most popular decentralized exchange on Ethereum.

The comparison in number of employees may seem unfair since Coinbase offers more services than Uniswap does but even if we account for that, I’d still wager that Coinbase has most of their workforce handling their trading infrastructure (which includes operations, marketing, development, customer support, legal etc). On the other hand, the Uniswap protocol doesn’t have most of this - I’ve never seen any real marketing efforts from the team nor do they have things like a customer support department. Coinbase and Uniswap are also regulated in a vastly different way mainly due to one fact - Coinbase is a custodian of cryptoassets whereas Uniswap is not. This one fact alone cuts down on human resource cost by orders of magnitude because Uniswap doesn’t have to worry about compliance with KYC/AML laws, financial regulations, insuring customer deposits, customer support and more. Put simply: you can’t and don’t have to regulate a decentralized protocol.

This doesn’t just apply to Uniswap either - any actually decentralized protocol on Ethereum will have a much less intensive human resource cost than a centralized organisation and that is a major reason as to why I believe DeFi will win. Centralized incumbents simply cannot compete in the long-term - their costs are too high, their companies too big which causes friction, they have to abide by so many different financial regulations which hamstrings their ability to move quickly and on top of all of that, their products are actually inferior. I’m sure I’m not the only one who much prefers using decentralized exchanges - they just have such a unique appeal to them.

I was around when Uniswap launched back in November of 2018 and I can tell you there were a lot of skeptics back then since many in the community didn’t understand how it worked (plus people considered Ethereum to be “dead”). Of course, those skeptics today are mainly just competing interests (centralized exchanges and other competitor products) which makes perfect sense for obvious reason.

Though, at this point one fact is undeniable - the Uniswap protocol has been an incredible success despite all of the headwinds it has had to face.

Have a great day everyone,

Anthony Sassano

Enjoyed this piece? You can get a fresh one sent straight to your inbox every week day by simply hitting that subscribe button below!

All information presented above is for educational purposes only and should not be taken as investment advice.