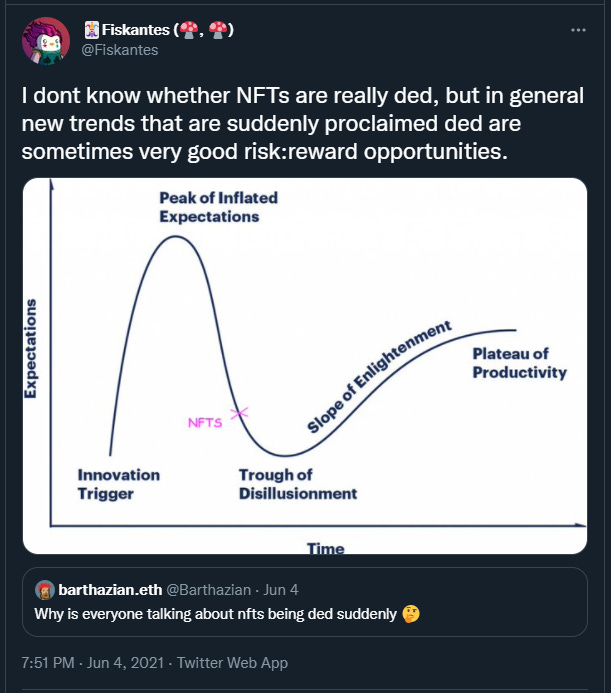

The tweet below is from June 4th but it popped up on my Twitter feed again today and I found it amusing because it was around the time that people thought NFTs were “dead”. Since then, we’ve had an insane NFT mania with returns that would make any hedge fund managers brain explode. In today’s piece I wanted to focus on another thing that some people don’t necessarily think is dead, but has been lagging - DeFi.

Source: https://twitter.com/Fiskantes/status/1400752114616393730

DeFi on Ethereum is currently in a bit of a weird spot - it had its “coming of age” moment during DeFi summer (June 2020 to September 2020) but since then progress and growth has been somewhat incremental. I would argue that DeFi is currently firmly in the “trough of disillusionment” part of the classic hype cycle as people’s insane expectations of DeFi haven’t materialized as they had hoped. Though I don’t think people are calling DeFi “dead” or anything like that - but it has been lagging the rest of the market over the last few months for a variety of reasons.

So, why has DeFi been lagging? Well the most obvious reason is that the Ethereum network’s fees have been quite high for a while now. It’s just the brutal truth that new users are unfortunately priced out of Ethereum’s layer 1 ecosystem which means that DeFi growth is contained within those who can afford it (at least, for now). The obvious “fix” here is getting more and more users onto various Ethereum scaling solutions such as Polygon’s PoS chain, Optimism, the forthcoming Arbitrum One and many other standalone solutions like Loopring and dYdX. Though, of course, this is going to take some time and be a slower rollout than the hype would have you believe.

I think the other major reason DeFi has taken a backseat is simply because DeFi just really isn’t anywhere near as fun as NFTs. I mean, if you really think about, finance is actually an incredibly boring thing for most people and I think that at best, DeFi has made finance just incrementally more fun. In saying that, I don’t think this is bearish for DeFi at all and I fully expect it to be a much bigger part of the crypto ecosystem than NFTs. In saying that, I believe NFTs will act as the front-end onboarding vehicle for many people while DeFi will sit in the background as an enhancer.

One other thing that I think is important here is to note that many DeFi teams have been deploying their apps to various chains (layer 1’s, layer 2’s and sidechains) throughout the ecosystem and adding incentives on top to drive usage. If I’m being honest, I think this is short-sighted and actually a detriment to each project the more times they do it. Once or twice is fine, but there are diminishing returns to these incentives and people now just farm and dump them at the first chance they get. On top of this, it just ends up fragmenting the teams focus which leads to slower development times and a poorer product experience for end-users. After all, you don’t need your product to be everywhere and dYdX is the perfect example of this as there is only 1 deployment of their perpetual exchange as a layer 2 (running on StarkWare’s tech) and they have seen incredible growth.

All in all, DeFi still has a very bright future ahead and I believe that it’s still going to replace the traditional finance ecosystem, but I think there needs to be a little more focus on the long-term from various teams. I also hope that with more and more DeFi projects deploying to layer 2’s, we can recapture the magic of Ethereum DeFi and onboard the next billion users.

Have a great day everyone,

Anthony Sassano

Enjoyed today’s piece? I send out a fresh one every week day - be sure to subscribe to receive it in your inbox!