There and Back Again: A DeFi Tale - The Daily Gwei #9

Where did DeFi come from and who were the “OGs”? That is, who was building in DeFi back in 2016/2017 or earlier before it was known as DeFi? That was the question that Peter Pan posed on Twitter today.

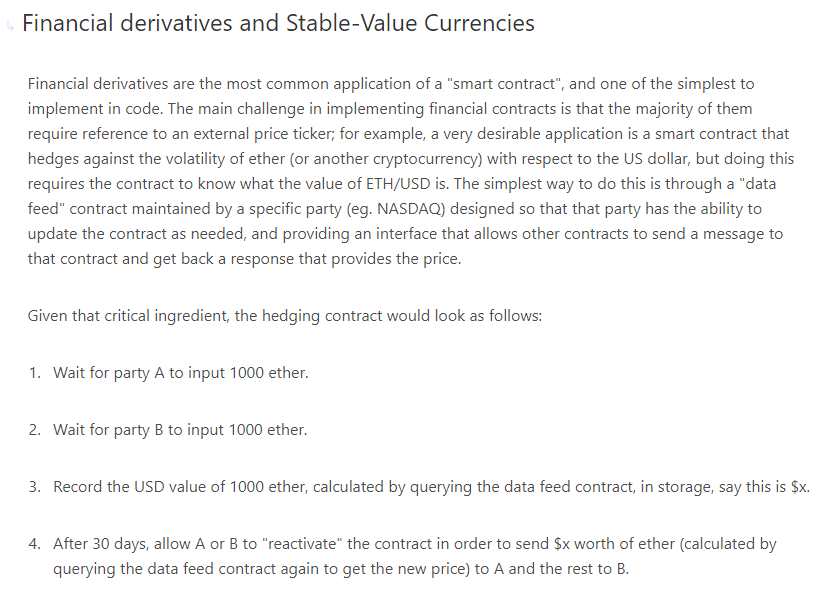

This got me thinking - can we pinpoint the exact moment that DeFi became a “thing” on Ethereum? Do ICO’s and TheDAO count as “DeFi”? What is the oldest DeFi project on Ethereum? Well, if you look back at the Ethereum whitepaper, you’ll see that financial use-cases have been spoken about since the very beginning. The excerpt below discusses price oracles and derivatives - good to also keep in mind that Ethereum’s whitepaper was published all the way back in 2013!

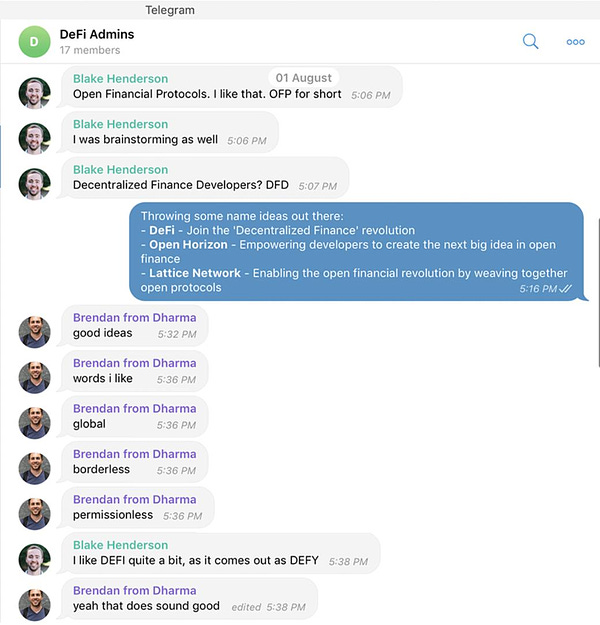

While this little excerpt shows that Ethereum was always meant to be used for financial use-cases, it doesn’t give us an answer as to when the modern day “DeFi” term entered the mainstream consciousnesses. For that, we have this very handy image of Inje Yeo of Set Protocol coining the term on August 1st, 2018 (along with Blake Henderson of 0x and Brendan of Dharma).

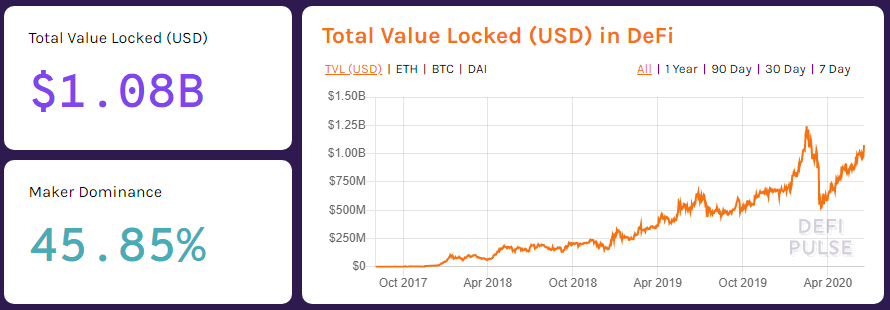

Alright, so now we know where the term came from, but when did DeFi protocols actually start being used and enter the mainstream consciousness? Many would argue that it was MakerDAO’s launch in December of 2017 that really kicked everything off because it gave us the first real money lego - Dai. Back then, there was no USDC, GUSD or any other stablecoin on Ethereum (Tether/USDT was on Omni). Thanks to this new money lego, developers were able to start experimenting with innovative ideas which led us to see the first real growth in activity and value locked in these new protocols. From Maker’s launch to the end of 2018, USD locked in DeFi went from $20 million to $230 million (a 11.5x increase)! Also worth noting that Maker’s dominance was 90%+ during this time while it’s now down to just ~46% as other protocols have grown.

Alright, back to Peter’s tweet. There were some really great answers in there of when “DeFi” projects started building on Ethereum such as decentralized exchanges like 0x and Kyber (both in 2017) and prediction market protocols like Gnosis (2017) and Augur (2015). If we look at the oldest project that’s still around in its current form and actively being worked on, that’d probably be Maker (launched in 2017 but conceptualized in 2014).

So to summarize: DeFi has always been around on Ethereum - just in different forms. It was originally in the whitepaper as standard “financial products” and continued that way into 2016 where we had TheDAO as the first large capital raising event on Ethereum. This was then followed by ICO’s in 2017 and in late 2017, the first breakout “DeFi” app, MakerDAO, went live. In 2018, value locked in Maker and other protocols started to grow with the “DeFi” term being officially coined on August 1st 2018. Then throughout 2019 we saw an explosion of growth, awareness and users for most DeFi apps that has continued into 2020.

I believe we’re now on the cusp of a new DeFi frontier - liquidity mining (as pioneered by Synthetix and popularized by Compound). I think this new mechanism for increasing liquidity, value and use of a DeFi app will be the next major narrative and result in an even larger amount of capital entering the Ethereum ecosystem than we saw in 2017 via ICO’s.

I’m excited (and a little bit scared)!

Have a great day everyone.

All information presented above is for educational purposes only and should not be taken as investment advice.