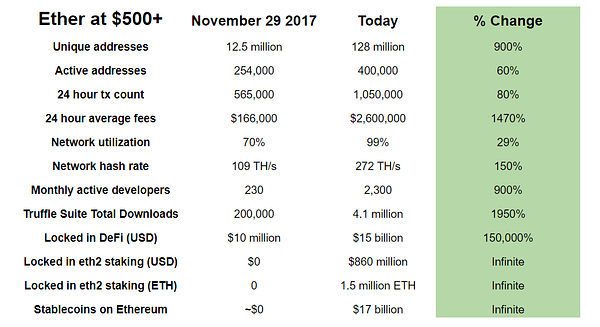

ETH first hit $500 on November 29th, 2017 and just recently ETH got back over $500 for the first since since early 2018. I decided to take a look at some metrics from back then and compare them to today - what I found was that Ethereum has had such incredible growth since November 2017 that I believe it now deserves the $500+ price tag.

I won’t go into every metric on the table but I will be focusing on the most interesting ones. Let’s start with something that has defined Ethereum in the second half of 2020 - gas fees. As you can see in the table, the 24 hour average fees was just $166,000 in November 2017 (during a retail-driven mania) whereas the fees today are $2.6 million in a much quieter market. Why is this the case? Well, it’s simple - the network is being utilized to do a lot more than just send ETH and tokens around - DeFi is the predominant use-case now and the Ethereum network is at near capacity almost every day because of it.

Speaking of DeFi - just look at that insane growth since November 2017 - though, to be fair, DeFi wasn’t a thing back then and we didn’t even have DAI until a month later. Even still, the Ethereum ecosystem basically built an entirely new financial system during the depths of the bear market in 2018/2019 and now we’re seeing the incredible results play out in 2020. Ethereum went from a platform for “just ICOs” to something that settles more value yearly than Bitcoin and ETH went from being viewed as just as “gas token” to a much more important and valuable asset.

I’d say the most impressive growth from this table that fits into the DeFi category would be the growth of stablecoins. In 2017 we had 1 stablecoin and that was Tether (USDT) which didn’t live on Ethereum - it lived on Omni (which leveraged Bitcoin). Since then, we’ve obviously seen an explosion in the number of stablecoins in existence as well as their market caps. We also have various different flavors including centralized (USDT, USDC), decentralized (DAI), algorithmic (ESD) and more are coming to market seemingly every week. I don’t foresee the stablecoin trend slowing down at all and I wouldn’t be surprised to see $1 trillion worth of them on Ethereum in the later stages of this coming bull market.

Lastly, during the bear market, the number of monthly active developers that flooded into Ethereum skyrocketed - growing from 230 to 2,300. Now, this is still small when compared to non-crypto developer communities but that just means that there is a substantial amount of room left to grow. If we can achieve what we have in Ethereum with just 2,300 active developers, imagine what we can achieve with 100,000 or 1 million?

I’m very curious to see how much these metrics grow by during this coming bull market and mania. I expect fees on Ethereum to go crazy again and I expect the value locked in DeFi to easily hit $100bil+ (could we hit $1 trillion?) and I expect ETH locked in eth2 to continue growing until maybe 5 or 10 million (it’s hard to estimate this though). One thing is for sure - Ethereum is going to continue to grow and there’s nothing anyone can do to stop it.

Have a great day everyone,

Anthony Sassano

Join the Daily Gwei Ecosystem

All information presented above is for educational purposes only and should not be taken as investment advice.