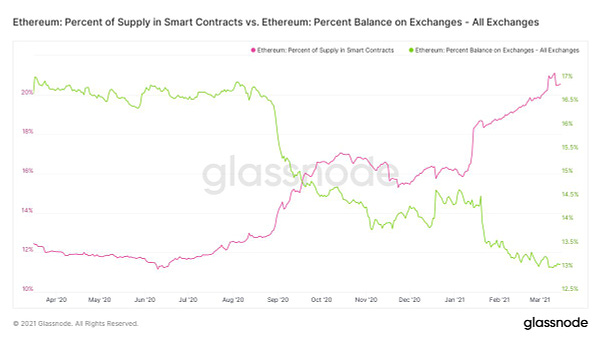

Since the start of DeFi summer in June of 2020, ETH has been pouring out of centralized exchanges and into smart contracts on Ethereum at a rapid pace. ETH in CEXs dropped from 17% to 13% since June while ETH in smart contracts increased from 12% to 20%. I would assume that the 4% difference would be people withdrawing ETH to their hot wallets or cold storage.

If we look at the ‘ETH locked in DeFi’ metric on DeFi Pulse we can see that since June 2020, there has been an increase from 2.7 million ETH locked to 9 million ETH locked (a 6.3 million increase) which represents ~5.5% of the current supply. Then, if we take the 3.6 million ETH staked in eth2 (~3.1% of the current supply) and add it to the ~5.5% we get a total of ~8.6% ETH across DeFi and eth2. Obviously this doesn’t fully map to the 8% we have above and I think this may be due to some double counting of staked ETH that is being used in DeFi (as collateral or in liquidity pools).

Okay so now that we’ve done the math we can move onto looking at what this ETH is actually doing in DeFi. Well to start with we have 3 million ETH sitting in Maker that is collateralizing around 1.6 billion DAI, 1.3 million ETH in Uniswap and SushiSwap being used as a trading pair asset and we have 1.2 million ETH in Compound and 600k ETH in Aave being used as collateral. Of course, there are many other DeFi projects that have ETH locked in them but these are the ones that sit on the top and it makes sense since DEX and money market activity still dominate DeFi.

Obviously this is all really positive to see because it shows that not only is DeFi growing, but it is taking power away from the centralized exchanges which really is the whole point of why we’re building DeFi in the first place. I don’t think we should sugarcoat it either - DeFi is here to disrupt and eventually replace as many centralized financial institutions as it can. Sure, fiat on/off ramps are still a thing that CEXs have a near-monopoly on but I believe that we’ll solve for that in time (or just bypass fiat altogether and live fully in the crypto world).

With many layer 2 solutions on the horizon and set to enable a new era of cheap & scalable activity, I expect to see more ETH (and other tokens) exit the centralized world and enter the decentralized one on Ethereum. Though I also expect to continue to see pushback from these centralized entities as they keep losing market-share (as we’ve seen from things like BSC) - the fight for decentralization is just getting started.

Have a great day everyone,

Anthony Sassano

Friendly reminder: Gitcoin Grants Matching Round 9 is now live which means you can donate to your favorite projects and get those donations matched quadratically! If you’d like to support all of the work I do at The Daily Gwei (both this newsletter and the YouTube Channel) then you can donate here. Thank you to all who donate!

Join the Daily Gwei Ecosystem

All information presented above is for educational purposes only and should not be taken as investment advice.