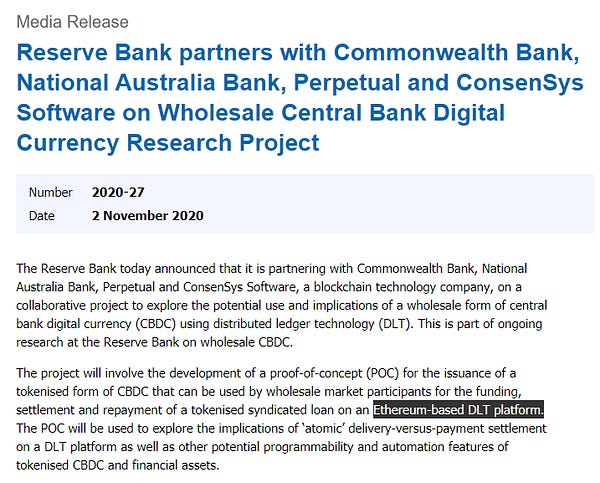

There’s been a lot of chatter about ‘Central Bank Digital Currencies’ (CBDC’s) in the crypto space lately and for good reason - many central banks have now announced that they are looking to deploy their own CBDC. The Federal Reserve in the U.S. has been talking about it, the European Central Bank has been talking about it, China is already conducting pilots and just yesterday the Reserve Bank of Australia (RBA) partnered with 2 of Australia’s largest banks to start research for an Ethereum-based CBDC. So, as you can see, things are happening fast.

I think the RBA’s announcement is probably the most noteworthy that I’ve seen so far because they explicitly mention using an Ethereum-based system. Though, don’t get too excited just yet, this simply means that they are almost certainly going to use a private implementation of Ethereum such as Quorum (which ConsenSys owns). This is okay though - I don’t think mainnet Ethereum is ready for the RBA (or any central bank) just yet because of both scaling and privacy issues.

Though the beauty of the RBA researching and developing this system using an Ethereum-based platform means that it’ll be much easier for them to either bridge into or adopt the public Ethereum chain later on. It’ll probably take years but I can see a world where something like a DAUD (digital Australian dollar) flows freely as an ERC20 token on the public Ethereum chain (albeit with a bunch of backdoors built-in like USDC). Even though DAUD would have to compete with other mediums of exchange on Ethereum, it’d have an instant user-base of millions of people if integrated with the existing bank infrastructure.

Now, a CBDC might seem unappealing to us Ethereans because obviously it’ll be centralized and will be controlled by the very institutions that we are looking to disrupt but I think that misses the forest for the trees. If CBDC’s make their way on to public blockchains, it basically cements them as critical financial infrastructure for the world and the speed at which they’re integrated into global finance will accelerate tremendously. This would then give people a choice - use a CBDC or use a decentralized alternative like DAI - each comes with their own trade-offs.

On top of all of this, central banks of different countries obviously want to increase the power of their own currency for a number of reasons so if they don’t deploy a CBDC and other central banks do, then they risk being left behind. I feel at this point it’s already turned into an arms race since China is leading the charge and the “western” countries obviously don’t want to let them propel the renminbi to new dominance heights.

So we’re entering into a weird world where governments and central banks will be experimenting with the crypto space in interesting ways - could you imagine seeing this even a year ago? Oh how far the space has come. Though, I still think it’s going to take a while for most countries to actually deploy CBDC’s widely because many of them still struggle with incredibly slow & inefficient financial infrastructure and introducing a CBDC would probably cause a lot of chaos/disruption.

Have a great day everyone,

Anthony Sassano

Enjoyed this piece? You can get a fresh one sent straight to your inbox every week day by simply hitting that subscribe button below!

All information presented above is for educational purposes only and should not be taken as investment advice.