Putting a Stake in It - The Daily Gwei #81

Some general thoughts on eth2 staking as we approach mainnet release.

With eth2 phase 0 on the horizon and staking coming along with it, there has been a noticeable increase in chatter on social media about the risks and trade-offs that early stakers will be taking. I’ve written about the risks before in this newsletter but I came across this excellent thread today and it got me thinking about a few things related to staking and eth2.

Firstly, it’s important to understand that staking in eth2 phase 0 is not going to be noob friendly. There will be tools such as the eth2 launchpad that will guide you through how to get started staking as a validator but even this requires some technical knowledge and uses many of the buzzwords that newer people may be unfamiliar with (validator, beacon node, validator keys etc). I actually don’t think this is a bad thing given that staking in phase 0 is going to be risky so we really only want those who understand exactly what they’re doing to participate - think of it as a form of protection for newer users.

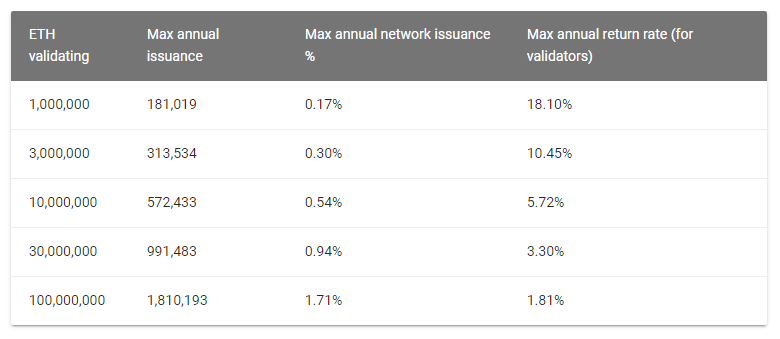

On top of this, sending your ETH from eth1 to the eth2 Beacon Chain (the new chain that’s being launched as part of phase 0) is a one-way trip which means you won’t be able to access this ETH for a few months (at the very least) and you won’t be able to move it around on the Beacon Chain. With all of the opportunities available on Ethereum right now to earn a return on your ETH, this makes staking even less appealing to a large number of people. Though, this is actually not a bad thing since the Beacon Chain only needs 512,000 ETH to get started and the rewards, while not as lucrative as yield farming, are still quite decent (and more sustainable).

Source: https://docs.ethhub.io/ethereum-roadmap/ethereum-2.0/eth-2.0-economics/#staking-rewards

There are also many risks associated with staking in phase 0 outside of the opportunity cost of locking your ETH for an undefined period of time. These risks are mainly related to events such as the protocol itself breaking and causing losses (like what happened on the Medalla testnet), slashing risk due to double signing, DDoS risk where someone can attack your validator and force you offline and, of course, the risk that you somehow lose your keys and are thus unable to access your validators or ETH.

Finally, exchange staking is also a really hot topic as it’s actually up in the air as to whether centralized exchanges will enable staking during phase 0. This is because of the one-way bridge nature and the fact that eth2 staking isn’t a delegated model so exchanges will have to spin up a validator for every 32 ETH that is staked. This brings with it additional overhead and costs compared to other staking protocols and may not be worth it for exchanges to do during phase 0. We’ll just have to wait and see what happens when phase 0 launches.

Eth2 phase 0 is most likely going live in the next couple of months (from what I can tell) so we are finally very close to seeing the culmination of years of research and development going live. I’ll personally be staking some of my ETH on day 1 plus adding more as time goes on and the chain stabilizes. I encourage you to get involved as well if you have the minimum required (32 ETH) or you can keep an eye on stake pooling services like Rocket Pool as well.

What an exciting time to be involved with Ethereum!

Have a great day everyone,

Anthony Sassano

If you’d like to support my on-going work to bring you a fresh Ethereum-packed newsletter every week day, feel free to make a donation on Gitcoin here (during the current matching round your donations are quadratically matched).

All information presented above is for educational purposes only and should not be taken as investment advice.

Staked eth will be locked in for 1+ years, as they need to figure out how Eth1 chain talks with Eth2. What about staking pools with tokenized representation of staking projects on ETH1? It may be usefull to figure out such projects? I just know of one, but I don't want to shill it here.