Mutually Assured Destruction - The Daily Gwei #526

If you try to censor us, we will nuke you from orbit.

Hey readers - I just wanted to apologize for the lack of newsletters over the last few weeks. Both my real life and crypto have been much busier than usual so it has been difficult for me to keep up the daily cadence of these newsletters. I haven’t even had a chance to write about the Tornado Cash sanctions (though I did talk about them at length on my 2 recent YouTube videos here and here).

Anyway, I can’t promise that I’ll be able to maintain a daily cadence of these newsletters for the foreseeable future but I will endeavor to keep publishing them as frequently as possible - thanks for sticking with me :)

Ethereum’s “social layer” has been quite topical lately due to the discussions being had around the Tornado Cash sanctions and the possibility of censorship on Ethereum. If you’re newer to the ecosystem you may not understand the importance of a crypto-networks social layer but make no mistake - it is the most important thing for a network and ultimately our last line of defense against any adversaries.

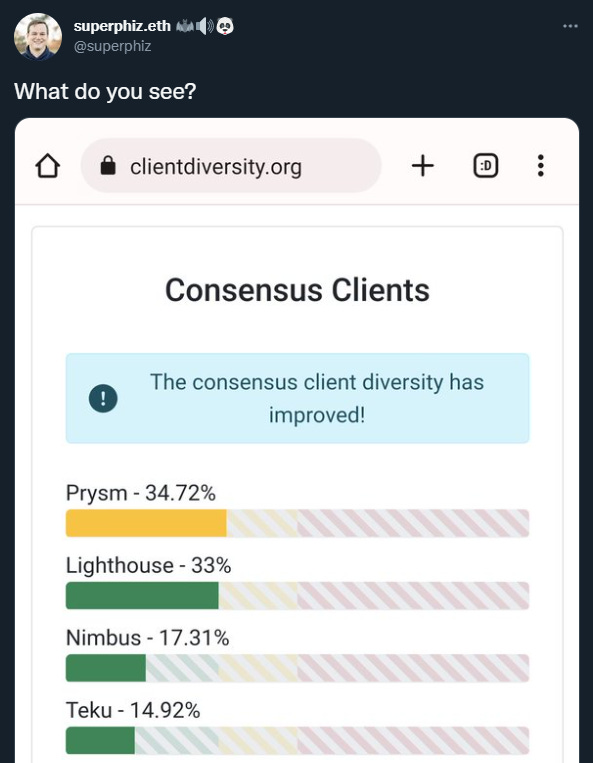

I think Superphiz’s tweet above is the perfect example of Ethereum’s social layer in action. To give the context - a little while ago the Ethereum Beacon Chain’s validator client diversity was quite uneven with Prysm accounting for 60%+ of the network (and at one point over 66% which is the critical level we don’t want any one client to reach). Given this situation, there was a huge community push (led by Superphiz and others) to get people to switch to a minority client. Well, you can see the results of this push above - Prysm went from being around 67% of the network to just under 35% and client diversity has never been healthier that it is today!

On this topic of the social layer, there’s been a lot of talk lately about potentially “socially slashing” any validators that decide to censor transactions on the Beacon Chain. I do want to be clear that this a “nuclear option” that would only be used as a last resort (and ideally it would never actually be used). This is because socially slashing large validating entities like centralized exchanges would lead to a lot of collateral damage for the entire ecosystem and a very messy time for Ethereum. Though the point of even talking about social slashing is to send a strong signal to these entities that censorship is an attack on Ethereum and will be met with an aggressive response in the worst case.

Another way to think about the above is that there’s a “cold war” going on at the moment where a type of ‘mutually assured destruction’ is at play. If a centralized staking service provider decides to censor transactions at the base-layer, then the Ethereum community would react with its ‘nuclear option’ of socially slashing the offending validators. Because of the nature of slashing (literally burning a validators stake), entities have every incentive not to engage in any behavior that could get them slashed (socially or technically). So instead of censoring transactions because a government told them to, the staking service provider could simply exit their validators from the active staking pool (because the threat of social slashing is ever looming if they instead choose to censor).

Personally I believe that if the Ethereum base-layer was to ever engage in permanent censorship, that would be the end of Ethereum. Our currently strong social layer would begin to break down, smart people would leave the ecosystem, developers would flee to other chains and users would abandon the chain in droves. Fortunately, I don’t see a future where the Ethereum base-layer becomes permanently censored - but only because I believe that Ethereum’s social layer is strong enough to resist this.

Have a great day everyone,

Anthony Sassano

Enjoyed today’s piece? I send out a fresh one every week day - be sure to subscribe to receive it in your inbox!

Join the Daily Gwei Ecosystem

All information presented above is for educational purposes only and should not be taken as investment advice.

New low-energy power generation technology with no risk, low cost and high return rate is looking for investors.

The biggest mining pool, which is also running a staking service, Ethermine, already is censoring base layer transactions and the Merge hasn't happened yet.

Circle/USDC jumped almost before being told to jump by the Treasury Department.

I find it extremely unlikely Coinbase, Circle's bed partner, won't be censoring base layer transactions in two or three weeks. (Yes, I saw the CEO's Twitter post--it was weasel-wordy and unpersuasive.) The idea that executives at large, regulated custodial institutions are going to risk millions of dollars in assets and possibly face 30 years in prison for highfalutin principle is crazy talk.