Obviously we all know the gas prices on Ethereum have been consistently high since around June of 2020 and have of course priced a lot of users out. Because of this, developers have had to get creative with how they optimize their apps to use the least amount of gas as possible and this has lead to some interesting results.

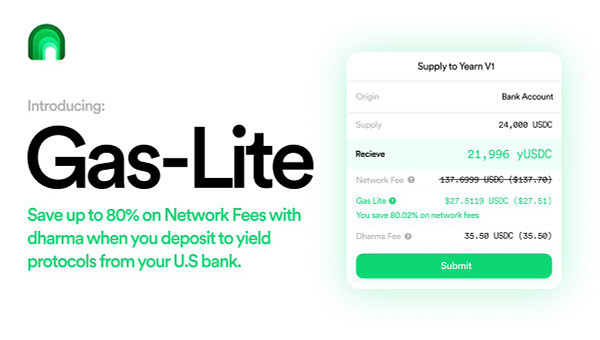

As you can see above, Dharma announced that they have come up with a new way to save up to 80% on network fees for their users. Basically how it works is that Dharma “pre-pays” for their users by depositing money into a DeFi app using their new ‘Trade Reserve’ (which is basically just a pool of capital that Dharma maintains). This of course comes with the trade-off that user funds are held in the reserve in a custodial way for the duration of the lockup period (5 days) but then the funds are moved to the user’s address after this period (assuming everything goes well). I think this trade-off is worth it for the gas cost savings!

Of course Dharma isn’t the only app coming up with innovative ways to save their users gas costs and I think another really cool example here is Yearn. Think about it - Yearn is essentially a protocol that creates yield-seeking vaults which are “user wrappers” - that is, they pool user funds non-custodially into a smart contract and then the smart contract itself pays the gas fees for any on-chain actions that the vault needs to perform. Put simply, instead of 1000 users each paying the gas fees to enter into a yield farming position, the Yearn vault acts as 1 “user” paying 1 gas fee for 1000 users. Pretty neat, huh?

The last example I’ll give here is Set Protocol because it is one of the apps that got hit pretty hard by the gas price rise. This is because in v1 of the protocol, when users bought one of the ‘Sets’, they were actually minting them directly from the smart contract which meant that the gas costs were in the $100’s of dollars (same for when users sold a Set). Now with v2 of the protocol, the gas costs have come down considerably and instead of users having to mint Sets from the contract directly, they simply use Uniswap to buy/sell them which works out to be much cheaper. The clear example here is the DeFi Pulse Index (DPI) - it’s very liquid on Uniswap and users can buy/sell with ease and much lower gas costs than direct minting.

There are also plenty of other things developers can do to lower gas fees for users such as optimizing their smart contracts, creating batched deposits/withdraws from liquidity pools, reimbursing gas costs with tokens (like what Balancer is doing) and more. Of course, the best thing developers can do to lower gas fees for users is to adopt layer 2 technologies but as those are still in their early stages optimizing layer 1 gas costs is the most prudent approach for now. It’s also not a zero-sum game as even with broad layer 2 adoption builders should still aim to optimize their code and be good stewards of Ethereum.

All of the above speaks to the title of this post - the power of human ingenuity. I’ve written about it before, but developers in Ethereum have an incredible knack for tearing down all sorts of walls in order to keep building the best possible products for users. I don’t know about all of you but when I invest in the Ethereum ecosystem I’m mainly investing in the people within it - and Ethereum has a near-monopoly on the brain-power in the crypto ecosystem.

Have a great weekend everyone,

Anthony Sassano

Join the Daily Gwei Ecosystem

All information presented above is for educational purposes only and should not be taken as investment advice.