HODL Waves - The Daily Gwei #337

Has 87% of the ETH supply really been idle for 3 or more months?

I love diving deep into various different on-chain Ethereum metrics - from tracking how the growth of layer 2 is fairing to observing the behavior of whale addresses. Though the thing I enjoy most about diving into on-chain data is that you can basically “double-click” into any metric and gain a much deeper look that allows for more unique insights.

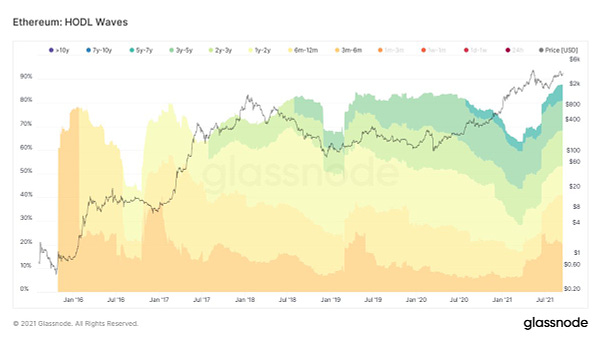

The chart above illustrates a metric called ‘HODL Waves’ that basically tracks how active the current ETH supply is. You can see from my tweet that 87% of the current ETH supply has not moved on-chain for 3 months or longer - but this doesn’t necessarily mean that this ETH is all just sitting in cold storage. For example, there is plenty of ETH sitting in DeFi apps like Maker and Aave that is being used as collateral for debt positions (though this supply is obviously not active most of the time). Then we can look at AMMs that have both an active and inactive pool of ETH - that is, if the price of ETH is trading around a range of $3,500-$4,000 for a month then any ETH not in that range in the AMM will just sit there idling.

Centralized exchanges also play a rather significant role in the HODL Waves metric because they tend to hold large reserves of ETH in cold storage (that mostly belongs to their customers, of course). The exchange operators will typically not access this cold storage unless they need to replenish the exchange hot wallet or if they decide to do some internal reshuffling for security reasons. But this doesn’t mean that the ETH sitting in cold storage can’t technically “change hands” on exchanges - the way CEXs work is that coins basically trade as IOUs - the CEX isn’t executing an on-chain transaction every time a trade happens (unlike DEXs such as Uniswap). Though in saying that, there’s only about ~13% of all ETH currently sitting on centralized exchanges anyway.

The biggest pile of ETH that is quite literally locked for quite a while is all the ETH sitting in the eth2 deposit contract. The reason I say this ETH is actually “locked” is because none of it can be accessed until the ability to withdraw from the deposit contract is implemented (most likely mid-late 2022). This means that ~7.7 million ETH (and growing) is temporarily removed from the active supply - most of it having been removed for quite a while now. There is also a bunch of other “provably lost” ETH such as those stuck due to the Parity multi-sig exploit and I think it’s safe to assume that most of the ETH that hasn’t moved in 5+ years is probably not ever going to move.

As you can see, taking on-chain metrics at face-value can be dangerous at times because there is always a much deeper thread to unravel. You’ll often see people sharing metrics on Twitter to try and paint a positive narrative for a specific coin but most of the time, when you add nuance, those narratives tend to fall apart. It’s best to stay vigilant if you’re using on-chain metrics as part of your investment or trading decisions.

Have a great weekend everyone,

Anthony Sassano

Hey everyone! Just a heads up that if you’d like to support my on-going work to bring you a fresh Ethereum-packed newsletter every week day, feel free to make a donation on Gitcoin here (the donation will be matched quadratically during the current matching round).

Enjoyed today’s piece? I send out a fresh one every week day - be sure to subscribe to receive it in your inbox!