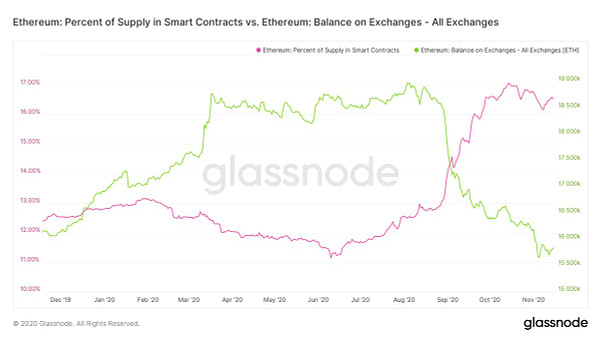

I was poking around on one of my favorite on-chain data websites, Glassnode, today and came across some incredibly interesting charts that clearly show the rise of DeFi and the fall of centralized exchanges. You can see from the chart below that ETH outflows from centralized exchanges accelerated rapidly as DeFi summer started kicking off after the COMP liquidity mining launch in mid-June. Where did this ETH go? Well, it went into smart contracts/DeFi or, to put it another way, it went Bankless.

For frequent readers of The Daily Gwei it won’t come as a shock to you that lots of ETH has poured into DeFi over the last few months due to the yield farming craze. Why keep ETH on a centralized exchange when you can yield farm with it by borrowing stablecoins against it, putting it into the ETH/stablecoin pools on Uniswap or just doing your normal trading on decentralized exchanges? Additionally, almost 100,000 ETH has already poured into the eth2 deposit contract and is ready to stake once the eth2 Beacon Chain goes live.

At this point, we’re seeing a paradigm shift in how people use their ETH and other Ethereum-based assets. Hell, as you probably know, even foreign assets like BTC are being tokenized at a rapid pace and moved to Ethereum with over 152,000 BTC ($2.5 billion worth) living on its network right now. Now, of course, most of this tokenized BTC is centralized because its in the form of WBTC so it doesn’t really count as going “bankless” but it does still take some power away from centralized exchanges so I’d count that as a win.

Over this same period (mid-June to today), ETH locked in DeFi is up from 3 million to 7.6 million - a 150% increase! Of course, this ETH isn’t just concentrated into one app either - it’s split among the most popular DeFi apps such as Maker, Uniswap, Compound, Aave, Balancer and more. This is a diverse and bankless financial system being built right in front of our eyes with ETH at the center of it as the networks reserve asset - how exciting is that?

I expect that we’ll continue to see ETH flow out of centralized exchanges as more opportunities pop up on Ethereum. I mean, most people just use exchanges as custody solutions and literally do nothing with the assets they have on there - why would they continue to do this if they knew there were opportunities they could get involved with on Ethereum?

After all, Ethereum is an economic nexus.

Have a great day everyone,

Anthony Sassano

Enjoyed this piece? You can get a fresh one sent straight to your inbox every week day by simply hitting that subscribe button below!

All information presented above is for educational purposes only and should not be taken as investment advice.

Follow and Support Me

Donations (sassal.eth and my Gitcoin Grant)

EthHub (ethhub.eth)