Popular blockchain game Axie Infinity has been exploding in usage lately along with a very healthy price rise for their AXS token (up over 300% over the last 2 weeks). I’m sure many of you probably only heard about Axie Infinity recently (because seemingly everyone on crypto twitter is talking about it) but the project has actually been around for quite a while. So, why all of the attention now?

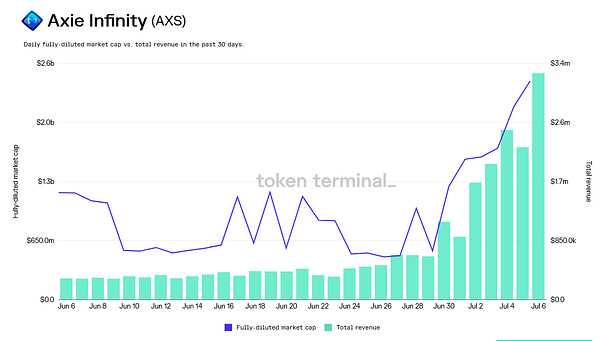

Obviously a lot of the attention is coming from the price rise of AXS but I believe it’s also coming from the fact that people are waking up to just how much revenue this pet-battler is making. In June, Axie Infinity made $12 million in revenue and in July the project has already made an insane $11 million in just 6 days. This revenue is mostly coming from marketplace fees and breeding fees but there are plenty of other ways that this game could be monetized. What I find most interesting about Axie Infinity is that their player-base is actually very different to your typical “crypto degen” as it’s predominantly people in the Philippines who play the game and earn a livable wage off of it! Yep, that’s right, it’s a relatively new trend in gaming called “play to earn” and I think it’s going to be a very big deal going forward.

So this brings me to my overall point - I think that fundamentals do matter - it might take months or years, but eventually the market wakes up and starts “repricing” certain assets and ideas. I think this is mainly because most of the crypto market is still made up of retail investors who mostly invest based on memes or marketing (this isn’t meant to be an insult, just an observation). Though I’d also say that it’s just because markets can be very inefficient and stay that way for much longer than you would think. I do believe that as this space continues to institutionalize (especially DeFi), we will see assets that are backed by fundamentals begin to reprice and climb the ranks on CoinGecko which is a sign of a healthy and more mature market.

In saying that, I have a rather unpopular opinion that I want to share - I believe that “memes” should actually be considered to be part of a projects fundamentals. Think about it - there’s a clear reason that Dogecoin is ranked #7 by market cap - and that reason is obviously the fact that it has amazing memes which act as powerful marketing vehicles. I think that a project would do well to develop a marketing strategy around memes because it can be very powerful - Gitcoin has the right idea (and funny enough this job posting became a meme in of itself). Though of course there is much more to fundamentals than just memes.

I think that fundamentals should be viewed holistically rather than in a vacuum. This is because every project is different and should not just be looked at in isolation - one project’s fundamentals could seem good on paper but then when compared to another project they could look relatively poor. This is also the reason why it’s going to take more sophisticated and experienced investors coming into this space in order for project fundamentals to actually be “priced in” - but I think that time is coming sooner than most people think.

Have a great day everyone,

Anthony Sassano

Enjoyed today’s piece? I send out a fresh one every week day - be sure to subscribe to receive it in your inbox!

Join the Daily Gwei Ecosystem

All information presented above is for educational purposes only and should not be taken as investment advice.

Hi Anthony. Great post. Did you happen to catch recent episode of Bankless re "Wanting" author and the Power of Mimetic Desire.....it talks about memes and how they are basically the manifestation of our collective desire to want to mimic/copy/imitate what someone else wants. Oh...you want that....I want that too now!