“The flippening” describes a future event in which Ethereum’s market cap surpasses that of Bitcoin’s and has been a talking point in the community since around 2017. Though over time this talking point has been evolved to cover all types of metrics that Ethereum has flipped Bitcoin on - not just market cap.

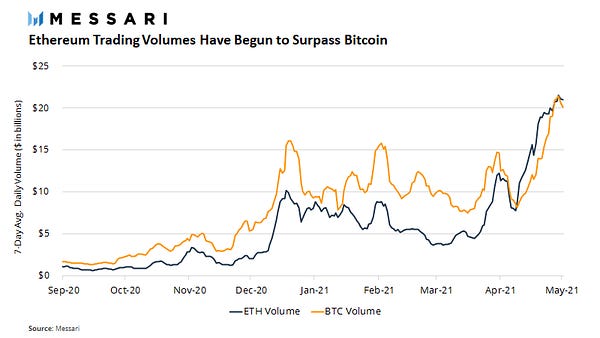

As you can see in Ryan’s tweet above, ETH’s trading volumes on centralized exchanges have flipped BTC’s since mid-April and if you head here you can see that ETH options volumes are also exploding. These aren’t the only metrics Ethereum has flipped Bitcoin on - it has consistently done more in transaction fees for a very long time and Ethereum also settles much more value than Bitcoin. On top of this, there are other metrics such as number of developers, apps and users that are all equal to or greater than Bitcoin.

In saying the above, I’m not sure that it’s even important to focus on these “flippenings” anymore. Ethereum is much, much bigger than Bitcoin as it’s attempting to disrupt so many different industries from finance to organisations to gaming. So from this point of view, comparing Ethereum to Bitcoin would be like comparing a general purpose computer to a calculator - one is a superset of the other. Now, this isn’t to say that Bitcoin isn’t valuable (obviously it is), but it fills a very small niche that a very small percentage of the world actually cares about. On the other hand, I believe that Ethereum’s total addressable market is literally every human on Earth.

So in saying that, what are the better ways to track and contextualize Ethereum’s growth and performance? Well, let’s start by tracking it against the industries that we are trying to disrupt! Starting with DeFi, we should be comparing things like payments volume on Ethereum to those of Visa, PayPal, MasterCard and others. Next, we should be comparing DEX trading volumes to CEXs and settlement volumes to banks. Finally, and this may be a bit controversial, I believe we should be comparing Ethereum’s market cap to that of gold (the most valuable asset in the world by market cap) - Ethereum’s is $330 billion whereas gold is $12.1 trillion - though I believe that Ethereum’s market cap will one day far surpass that of gold.

All in all, Ethereum is still in its exponential growth phase and I don’t see this slowing down anytime soon. This growth is also in spite of the extreme scalability limitations which makes it all the more amazing - imagine what’s going to happen when the layer 2’s are all rolled out! Though the scalability challenges have never stopped the builders because when you give them a platform that they can build anything on - magical things happen.

Have a great day everyone,

Anthony Sassano

Join the Daily Gwei Ecosystem

All information presented above is for educational purposes only and should not be taken as investment advice.

Excited about each stage of the Flippening. Excellent post!

Great piece! Really puts ETH in perspective