Fear and Greed - these are the 2 most powerful human emotions when it comes to the crypto markets (or really markets in general). If you think about it, a price chart is really just a visualization of these emotions and you can spot something like ‘extreme fear’ on the chart by looking at ETH at $80 in December of 2018 and $4,400 in May of 2021 being ‘extreme greed’. Though somewhere in the middle of these 2 emotions is where many of the long-term builders and thinkers in this space sit - and that’s what really matters.

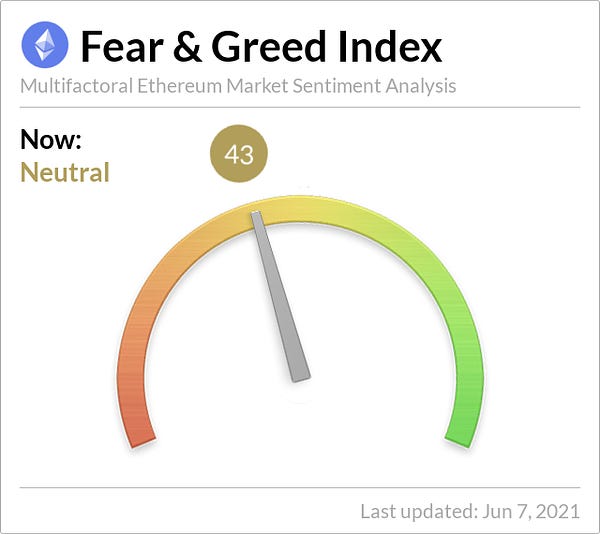

The index above aims to quantify the current sentiment of the ETH market so that speculators can trade off of this data (and general observers can get an overall feel for the market). I haven’t done the back-testing on this indicator myself (nor do I have access to the raw data), but it’d be really fun to see just how accurate this indicator turns out to be over the long-term. For example, say you bought ETH at the ‘extreme fear’ end of the dial - does this mean that you bought the bottom? What about selling on the ‘extreme greed’ end of the dial - did you successfully sell the top? I think the answer to both of these questions is: maybe! This is because trading and investing can’t just be boiled down to a simple indicator like this because there are many other variables at play.

This brings me to something that I think about quite often - how much confluence is there between the general sentiment of market participants and the fundamental value drivers of something like Ethereum? Well I believe that they are tightly coupled for a number of reasons but the simplest reason is that positive price appreciation is a source of legitimacy for Ethereum; the more the price goes up, the more attention Ethereum gets, the more developers and users are exposed to Ethereum, and ultimately this can also be reflexive for the price. I’m sure many of you reading this remember just how bad sentiment was for Ethereum in 2019 and I believe this had a lot to do with the price action as ETH had fallen enormously against both its USD and BTC all time highs.

If I had to pick what emotion that I thought was more powerful I would say that it’s definitely fear. Think about it - the fear you feel when your portfolio value falls by 50% in a week is much greater than the greed you feel when it doubles in a week- the feeling of loss is simply much greater than the feeling of gain. Longer-term crypto market participants always have this at the back of their mind so they may not even feel any kind of greed or happiness as prices are rising because they know that at any time the rug could be pulled from underneath them and honestly they’re right to think like this - it’s a defensive strategy to dampen the blow when things get really dicey like what we saw play out over the last month.

In saying all of this, not everyone’s sentiment is going to be swayed by market movements. There were plenty of builders who kept on chugging along through the 2018/2019 bear market even though the general sentiment around price was incredibly dull and firmly on the ‘fear’ side of the dial. Sure, these builders felt the pain of a bear market just like everyone else, but they pressed on because they believed that what they were building was valuable and that the bear market wouldn’t last forever - and they were right.

Have a great day everyone,

Anthony Sassano

Join the Daily Gwei Ecosystem

All information presented above is for educational purposes only and should not be taken as investment advice.