Ethereum Flips Bitcoin, One Metric at a Time - The Daily Gwei #4

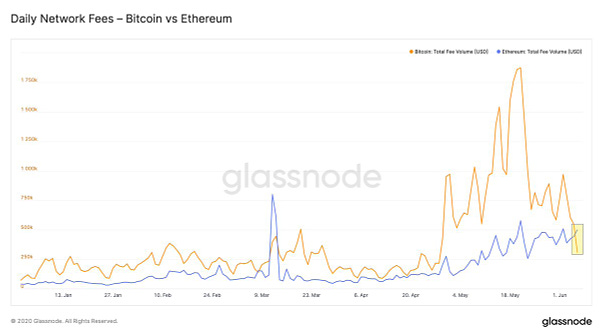

A couple of days ago, fees paid on the Ethereum network surpassed those paid on the Bitcoin network - again.

The last time this happened was during Black Thursday when gas prices spiked so high (200+ gwei!) that it resulted in a partial “meltdown” of DeFi. Since then, the reason Bitcoin’s fees have been high was because the halvening that occurred on May 11th meant that miners dropped off the network leading to longer block times and a more backlogged mempool. Though, as you can see, recently the fees on Bitcoin have come down again which is due to the mining difficulty adjusting and the hash rate starting to come back online.

What you’ll also notice from the fee chart above is that, unlike Black Thursday in March, Ethereum’s fees have been increasing gradually and in a more sustainable manner. What’s causing these high fees? Well, that’s easy to answer if we look at ETH Gas Station - Tether (USDT) and lots of scam/ponzi activity (MMM, SmartWay, Easy Club etc) - and sometimes someone even spends over 10,000 ETH on fees!

USDT transfers are a simple ERC20 transaction which means the gas cost is much lower than something like a complex DeFi interaction. Though, the reason USDT accounts for so much of the fee volume is because it’s mostly used for moving money between exchanges (arbitrage) + on-chain volume for USDT and other stablecoins reached an all-time high in May.

In saying that all of that, we’re all aware of how painful the high fees have been for the casual user of Ethereum. While moving ETH and ERC20 tokens around is still relatively inexpensive, the more complex interactions (such as using DeFi protocols) have reached a point where they are starting to price out casual users. This is obviously not a great outcome for the long-term health of Ethereum but I don’t think it’s so critical that it “kills” Ethereum in any capacity - after all, people are still willing to pay those fees to use Ethereum’s scarce block space to do things that provide value to them.

So, where do we go from here? Well, I’ve noted in a Twitter thread recently that I believe the sustained high fees will push more projects/teams to innovate at layer 2 and through other scaling means. We’re already seeing some of these efforts come to life with Loopring’s zkRollup DEX, Synthetix running experiments using optimistic rollups, StarkWare launching their StarkDEX with DeversiFi and more.

You may also be wondering, what about sharding in eth2? Well, that’s still a couple of years away at best and it’s currently a heavy active research and development project. It should be noted that sharding is also not a “fix all” solution for scaling issues - Ethereum will need a multi-pronged scaling approach and that’s where layer 2 and other efforts come in. There’s even a company working on fee market prediction engines!

Have a great day everyone!

All information presented above is for educational purposes only and should not be taken as investment advice.