Chicken Tenders... on the Blockchain - The Daily Gwei #41

We're going to do it all again, aren't we?

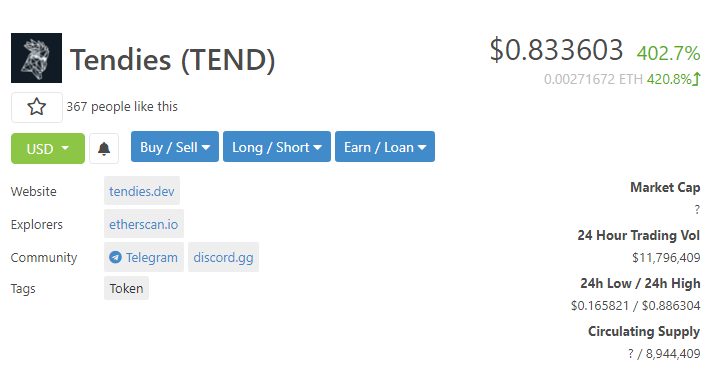

Alright so it seems we’ve already reached the “peak absurdity” part of the DeFi token cycle with the launch of the new ‘Tendies’ token on Ethereum. The craziest thing about this new token is that it actually has almost $12 million worth of trading volume over the last 24 hours - all enabled by permisionless listing on decentralized exchanges such as Uniswap and Balancer. But don’t get me wrong - this is actually a worrying sign of what’s to come.

Just… why? (source: https://www.coingecko.com/en/coins/tendies)

I’m not going to focus specifically on the Tendies token but I did want to dive into some thoughts around where we go from here. Basically, it feels like we’re entering another 2017-like ICO mania except this time it’s going to be with tokens that are built on “ponzinomics” that try to hide behind the “DeFi token” brand to gain legitimacy. We’ve already seen forks of the YFI token spring up and there’s an open debate over whether these things are actually scams or not.

Regardless of whether they are “scams” or not, these things will proliferate a lot faster and go a lot further than they did in 2017 for multiple reasons but the one that sticks out is the fact that scams now have access to instant and broad liquidity. In 2017, if you spun up some ICO scam, your best chance at getting liquidity was being listed on a centralized exchange. Otherwise, you could list your token on EtherDelta (a primitive decentralized exchange) and hope that people started trading it - there was no Uniswap, no Balancer, no 1inch or anything of the sort in 2017.

The /biz/ section (NSFW) on 4chan also plays a large role in getting these tokens on people’s radars by doing a few things. First, they’ll compare them to the other tokens that have pumped a lot recently to induce fomo. Then, they’ll start creating memes because, as I’ve explained before, meme magic is real. This will go on for a few days or weeks - just enough time for those perpetuating the token pump on 4chan to sell out just before the whole thing collapses. Don’t get me wrong though, 4chan is just one website of many where people go to find or shill these tokens (Telegram is also a popular tool for this).

Finally, I imagine many of these copycat tokens/scams are going to play on the “yield farming” trend to juice liquidity in order for them to exit - I’ll explain how this works. Basically, this scheme is what I like to call “subsidized liquidity” - the scammers are paying out tokens to people who provide liquidity so that they can dump their share into the market. As an example, let’s say the scammer allocates 10% of the total token supply to themselves and then 90% to the “liquidity mining” incentives. While everyone is distracted by the high APY numbers, the scammer quietly dumps their tokens into the liquidity that people are providing on Balancer and Uniswap (they are doing this to earn that high APY). Creative, right?

Unfortunately, it’s very easy to get scammed in this industry and I only think it’s going to get worse from here. As a friendly warning, I implore you not to try and chase every token marketing itself as giving “1000% APY” or anything like that as the best way to make money in this industry is to simply formulate a sound investment thesis and stick to it.

Have a great weekend everyone,

Anthony Sassano

All information presented above is for educational purposes only and should not be taken as investment advice.