A Token of Appreciation - The Daily Gwei #53

How tokens on Ethereum have evolved over the years.

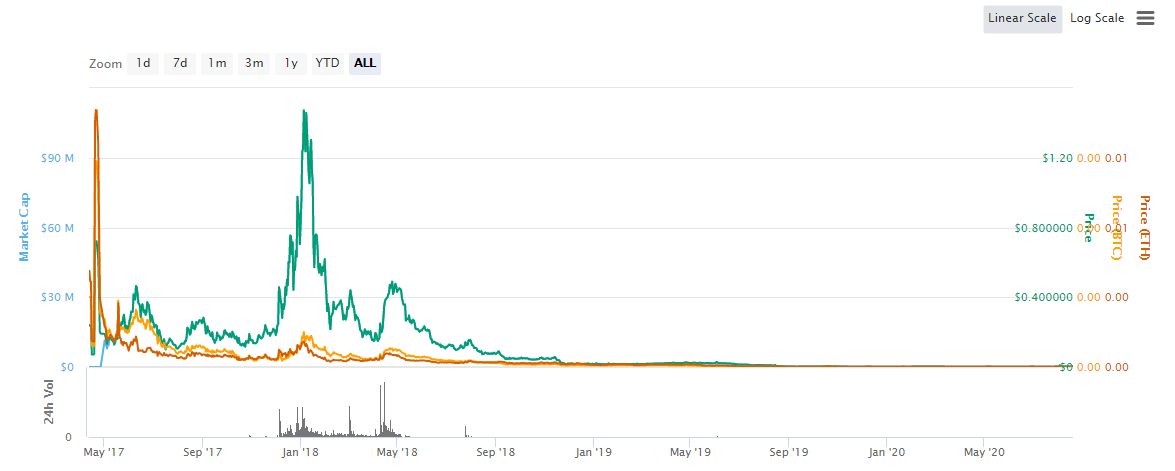

The token design space has been constantly iterated on since the very early days of Ethereum. First, in 2015/16, it was a bunch of projects issuing what are known as “utility tokens” - basically tokens that users had to buy in order to interact with a protocol but had no incentive to hold it after that. This trend of utility token creation continued into 2017’s ICO mania but once the market cooled down, these tokens were proved to actually be “futility tokens” in that they had no way to capture any sort of the value generated by the underlying protocol so most of them ended up down 99%+ from their all time highs.

A typical “futility token” chart.

Now it’s 2020 and the hottest tokens on Ethereum are ones that have strong “tokenomics” and resemble something more like a stock or equity than just a useless utility/payment token. Clear examples of these tokens include SNX, LEND and KNC which all enable token holders to share in the revenues generated by the underlying protocol, participate in governance and some even act as insurance for the protocol. The funny thing is that these tokens have all been around since 2017 (SNX was called Havven back then) but it’s only over the past few months that they have appreciated significantly in value alongside the growth of their respective protocols. This is because these tokens were redesigned from the ground up by their respective teams using the lessons learned from 2017 and earlier.

Another critically important but less talked about aspect of these tokens is that some of them have supply sinks; that is, there are mechanisms that act to take supply out of circulation which has a direct effect on price. The clearest example of this is SNX - the native token of Synthetix. What makes SNX really special is that it has a built-in incentive mechanism that works to align all actors in the system. Basically how it works is that users put up their SNX as collateral through the Synthetix system, generate synths with this collateral and then each week earn an SNX-denominated reward + an exchange fee reward. The real magic here is that the SNX reward is locked for a year from the claim date which means that increase in supply does not materialize immediately. These incentives have worked to bootstrap the Synthetix protocol, take a large chunk of SNX out of circulation (leading to price rises), and created an army of “Synthetix Spartans” that are extremely active.

The Synthetix model is something that many projects are now looking to emulate and improve upon with their own “liquidity mining” programs. I don’t want to call out any specific projects here but there are some that have done this very poorly and will be dealing with the consequences of this for years to come. I’m of the opinion that a good liquidity mining program is one that is constantly tweaked and improved upon by the team and community as having it just “set in stone” from day 1 is silly and leads to perverse outcomes over time.

As I explained in yesterday’s money games piece, I think teams are going to continue to iterate on these designs at an extremely rapid pace which means token and liquidity mining designs may look vastly different from what they do today as I personally believe there is still so much unexplored territory left in this area.

Have a great day everyone,

Anthony Sassano

All information presented above is for educational purposes only and should not be taken as investment advice.